in the world finance, 10 Years are the blink of an eye. Want proof? Take a closer look at the table below:

|

a company |

Market Cap 2014 (in billions) |

Market Cap 2024 (in billions) |

|---|---|---|

|

IBM |

$182 |

$178 |

|

Nvidia |

$10 |

$2,965 |

In August 2014, IBMThe company’s market value was about 18 times greater than Nvidia‘s (NASDAQ: NVDA)But oh, how things turned out. today, Nvidia It has a market cap of around $3 trillion – almost 17 times larger than IBM.

So, we look forward to the future. 10 years what These are the companies that May exceed appleHow big is Amazon’s market cap? Here are two companies that could make it happen.

Microsoft

If a company is going to overtake Apple in the next decade, it will need a huge market cap. And even if we assume that Apple’s market cap stays the same, This means The company will need access to: Market value $3.4 trillion to pursue Apple.

It is a very difficult task, and there Only a limited number of companies who I can do it. Microsoft (NASDAQ: MSFT) He is one of them.

For starters, Microsoft’s market cap is already $3.1 trillion. As of the time of writing this. like Recently in June, Microsoft announced Did he have Market cap greater than Apple. Moreover, Microsoft has some competitive advantages that could, over time, help the company’s market value surpass Apple’s.

First, Microsoft has a more diverse business. The company is involved in cloud computing, gaming, advertising, hardware, software, social networking, and artificial intelligence. In short, Microsoft has many paths to success. apple, On the other hand, the company has traditionally benefited from its outstanding hardware innovations. While Apple’s services and AI could boost the company’s revenue, declining iPhone sales could pose a real challenge for Apple over the next decade.

In my book, that means an advantage for Microsoft.

Nvidia

I own Nvidia Reservations NowIts high valuation makes it vulnerable to a bad correction if the company’s sales show any Signs of slowing down. However, this article is about what could happen in the next ten years. In this case, I think Nvidia is well positioned to outperform Apple.

That’s because Nvidia’s core business — making the graphics processing units (GPUs) that will power advanced AI systems for the next decade — is on a long-term growth trajectory that Apple doesn’t expect. simply Cannot match.

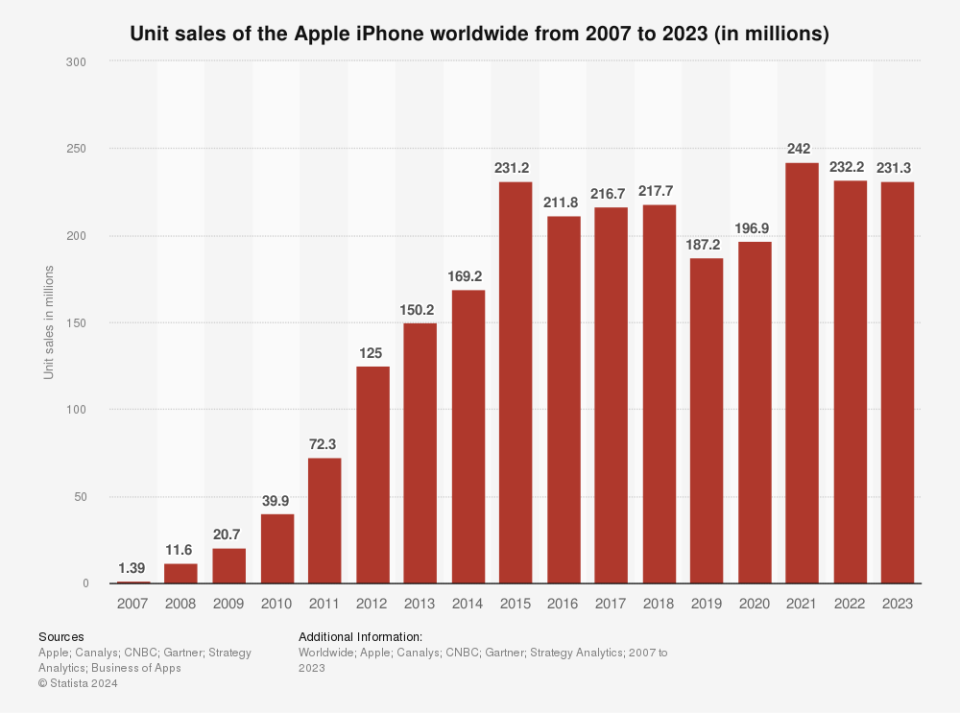

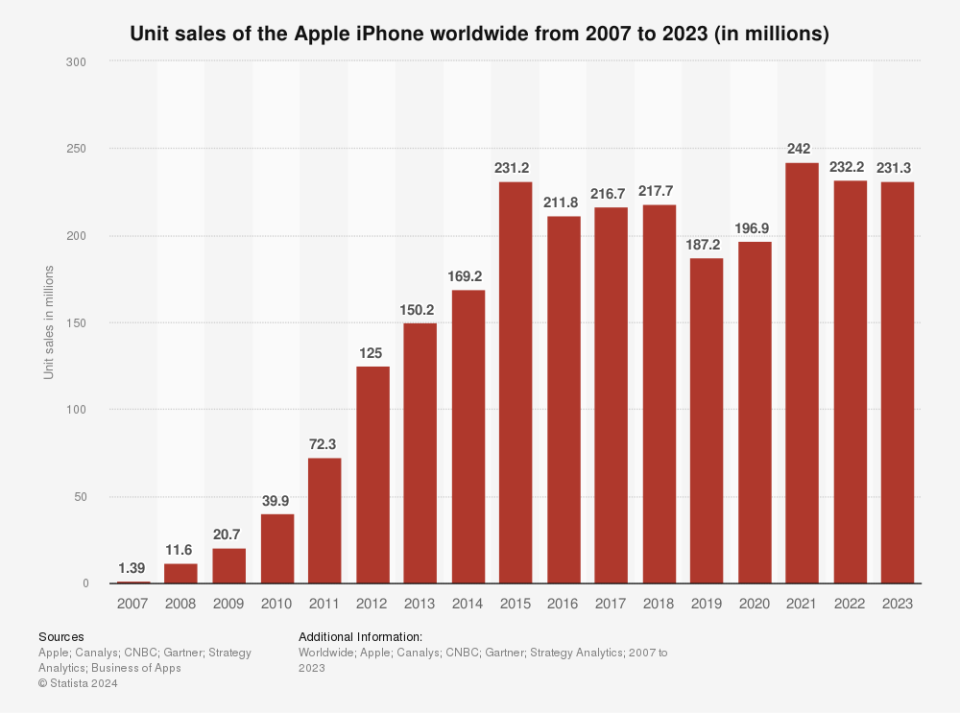

Sales of Apple’s flagship product – the iPhone – rose every year between 2007 and 2015, but have remained flat since then.

On the other hand, Nvidia is still growing. Over the past two years, the company’s revenue has tripled as it sells GPUs at a high rate. This growth not so It is likely that slow In the next few years. Most analysts expect Nvidia’s sales to double again to about $160 billion by 2026.

There are certainly some challenges ahead as rivals seek to take market share away from Nvidia in the booming AI chip market. But even if Nvidia’s sales growth slows, it could easily close the $500 billion market cap gap with Apple over the next decade.

Should you invest $1,000 in Microsoft now?

Before you buy Microsoft stock, keep this in mind:

the Motley Fool Stock Advisor The team of analysts has just identified what they believe to be Top 10 Stocks There are 10 stocks for investors to buy right now… and Microsoft isn’t one of them. The 10 stocks that do make it could deliver massive returns in the years ahead.

Think about when Nvidia I made this list on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $758,227.!*

Stock Advisor It provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has More than four times S&P 500 Index Return Since 2002*.

*Stock Advisor returns as of August 22, 2024

Jake Lersh The Motley Fool has positions in International Business Machines and Nvidia. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends International Business Machines and recommends the following options: Buy $395 Jan 2026 Microsoft and Sell $405 Jan 2026 Microsoft. The Motley Fool has Disclosure Policy.

Prediction: Two Stocks That Will Be Worth More Than Apple 10 Years From Now Originally posted by The Motley Fool

“Freelance web ninja. Wannabe communicator. Amateur tv aficionado. Twitter practitioner. Extreme music evangelist. Internet fanatic.”