FOX Business’ Sherrill Casson reports on the June CPI released on Wednesday, which revealed that inflation is now at a 40-year high.

Michael Ringing, chief strategist at the New York Stock Exchange, argued on Wednesday that markets were “well prepared” for the headline inflation number released earlier, but stressed that the data was “bad.”

Speaking with Fox News Digital, Reinking also noted what the latest inflation data, which is at a 40-year high, means for The Fed’s Next Moves While central bank officials are trying to calm rising inflation.

On Wednesday morning, the Labor Department said the Consumer Price Index, a broad measure of the prices of everyday goods, including gasoline, groceries and rents, rose 9.1% in June from a year ago. Prices jumped 1.3% in the one-month period in May. Both numbers were well above the 8.8% headline figure and economists at Refinitiv had forecast monthly gains of 1%.

The New York Stock Exchange on Wednesday, July 13, the day the Labor Department released inflation data for June. (Fox Business/Talia Kaplan)

The data points to a file faster inflation rate Since December 1981.

Wound inflation swelled 9.1% in June, accelerating more than expected into new 40 years

“I think the markets were well prepared for the headline figure to be much hotter than expected,” Reinking told Fox News Digital, referring to the mid-June price of gas, which he said was peaking at the time.

“We have seen a rise in gasoline prices over the past month,” he said.

In the past month, gas prices have reached record levels with the national average exceeding $5 a gallon.

On Wednesday, the national average for a gallon of gas was $4.63, about 40 cents less than the previous month when it was more than $5, according to AAA.

Reinking argued that the so-called core price data, which exclude the most volatile measures of food and energy, provided a bit of a surprise.

The Labor Department said core prices rose 5.9% from a year earlier. Core prices also rose 0.7% m/m – higher than in April and May – indicating that core inflationary pressures remain strong and widespread.

“The core CPI was where the problem really lay because we didn’t see any kind of slowdown in that data,” Reinking said. “When you look at all the different components, we were hoping to see some easing in the prices of used cars, cars, maybe clothing given what we’ve heard from retailers and we haven’t seen any of that.”

The worse-than-expected report is expected to have major implications for the Federal Reserve and is likely to fuel a series of sharp interest rate hikes in an attempt to rein in rates. Policymakers already raised the benchmark interest rate by 75 basis points last month for the first time since 1994 and confirmed that a similar-sized increase is on the table in July.

Reinking argued that with inflation higher than economists expected in June, Wall Street is now raising the odds of a massive 100 basis point rise in July.

The market analyst noted that the Fed has indicated that it wants to see inflation data “significantly lower for several months” before it steps off the gas pedal.

He said the data released on Wednesday “resets the clock” because it revealed there was no “slowdown”.

The rethink went on to argue that while Wall Street “widely expected the Fed to go to another 75 basis points at the end of July,” Wednesday’s data opens the door to a potential 100 basis point rate increase.

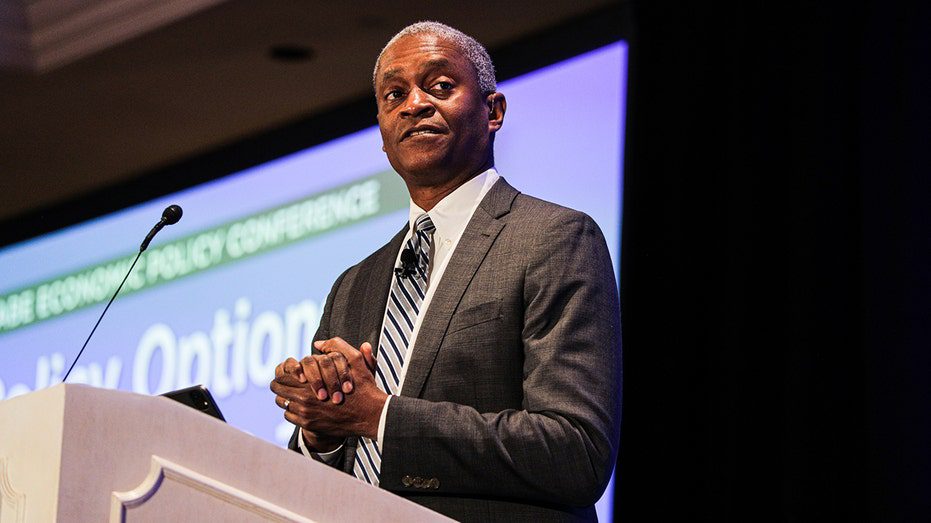

Rafael Bostic, President and CEO of the Federal Reserve Bank of Atlanta, speaks during the National Association for Business Economics (NABE) Economic Policy Conference in Washington, D.C., U.S., on Monday, March 21, 2022. (Valerie Bleach/Bloomberg via Getty Images/Getty Images)

He referred to a comment made by Atlanta Fed President Rafael Bostic earlier on Wednesday, saying that “It’s all in play” Asked about the possibility of the central bank raising interest rates by a full percentage point later this month.

About 38% of traders are now pricing in opportunities for a 100 basis point increase later this month, according to CME Group’s FedWatch tool, which tracks trading.

However, the Fed is in a precarious position as it walks the line between cooling consumer demand and bringing inflation closer to its 2% target without inadvertently dragging the economy into recession. Higher interest rates tend to create higher rates on consumer and business loans, which slows the economy by forcing employers to cut back on spending.

When asked if he thinks the Fed can manage to engineer an elusive easy landing, Reinking told Fox News Digital, “It’s threading a needle.”

Summer Larry warns of inflation unlikely to fall without ‘major economic downturn’

“I think there is a possibility,” he said. “We’re coming from a very good place from an economic perspective, especially for the rest of the world…so there’s potential, but it’s going to be a lot of pressure.”

Reinking also noted that “there is a possibility” that Wednesday’s data will be “peak inflation,” especially when looking at “what the commodity markets have done over the past few months.”

He also warned that investors will likely “continue to see a significant amount of volatility as markets are kind of dealing with this ebb and flow of economic data and the Fed’s policy path going forward.”

Hennion & Walsh Asset Management President and CIO Kevin Mahn analyzes Wall Street’s volatile day in “The Claman Countdown.”

Ringing noted that the United States was “experiencing a clear economic slowdown.”

He continued, “The bigger question from here is how deep and how long this slowdown will be, and inflation and the Federal Reserve and their reaction to inflation will play a big role in how long this prolongation lasts.”

The rethink also revealed what is believed to be a “big concern” in the markets at the moment.

“The concern in the markets is that the Fed will amplify the initial policy mistake by not responding to inflation data early enough and then they will now have to tighten up in an already slowing economy and thus amplify that and create an even bigger slowdown,” he explained.

Financial strategist at Odeon Capital Group reviews the second-quarter earnings of Wall Street financial giants in “Claman Countdown”.

Reinking spoke with Fox News Digital as the second-quarter earnings season kicks off with JPMorgan Chase, Morgan Stanley, First Republic Bank, Cintas and Conagra Brands leading earnings ahead of the market open Thursday.

He argued that Malians “are sitting in a very good place to understand kind of what’s going on from a holistic perspective.”

“I think one of the big keys we’ll see this quarter is whether banks will really start to increase provisions and reserves for loan losses in the future,” he added.

“Because we’re anticipating a slowdown, we’re kind of reversing the trajectory of back-up runoff that we’ve seen over the past year,” Reinking continued. “They are now [banks] You will have to start building those reserves again to prepare for a more challenging credit environment.”

Get your FOX business on the go by clicking here

On a more general note, Reinking argued that if management teams start cutting guidance “and the market can get comfortable with that guidance being somewhat more conservative, it may help stabilize things here in the near term.”

FOX Business’s Megan Heaney and Brick Dumas contributed to this report.

“Beer aficionado. Gamer. Alcohol fanatic. Evil food trailblazer. Avid bacon maven.”