- The price of Bitcoin has fallen by more than 4% in the past 24 hours.

- Most market indicators and metrics indicated further decline in prices.

Bitcoin [BTC] It has struggled to turn to the upside over the past couple of days as its price continues to trade below $67K.

However, the entire trend may change soon when a leading indicator points to a potential price increase that could allow the crypto king to touch $86K in the coming weeks or months.

Bitcoin’s path to $86,000

Last week was dominated by bears, causing the prices of most cryptocurrencies to fall, and Bitcoin was no exception. according to CoinMarketCapBTC saw a major price correction on June 6th.

The price of the coin has fallen by more than 4% in the past seven days. At the time of writing, BTC is trading at $66,344 with a market cap of over $1.3 trillion.

However, Ali, a popular cryptocurrency analyst, recently published an article tweet Highlighting a fact that gave hope for a price increase. According to the tweet, the cost of mining Bitcoin was $86,668.

If historical trends are taken into account, Bitcoin could start a bullish rally soon, as it has always risen above the average mining cost.

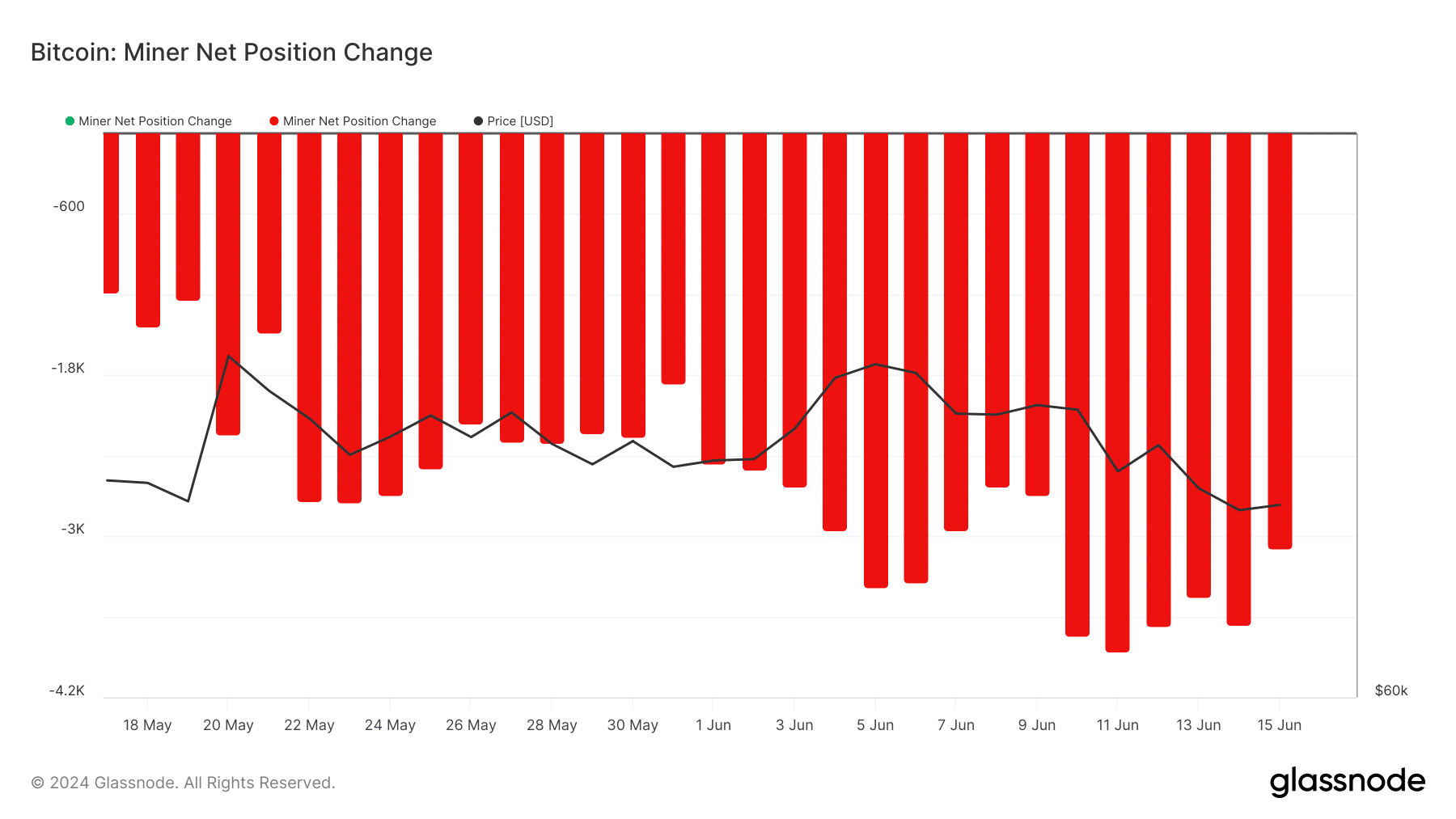

AMBCrypto then analyzed Glassnode data to see how miners were behaving while the cost of mining BTC reached $86,000. We found that they have an intention to sell.

This was evident by the massive decline in miners’ net position change, showing that miners were not confident in Bitcoin and thus chose to sell their holdings.

Miners’ balance has also been declining over the past few weeks.

Source: Glassnode

Will BTC remain bearish?

Since miners were putting selling pressure on Bitcoin, AMBCrypto planned to take a look at other data sets to see if Bitcoin would remain bearish.

AMBCrypto Analysis of CryptoQuant Data It revealed that net BTC deposits on exchanges were high compared to the average of the past seven days.

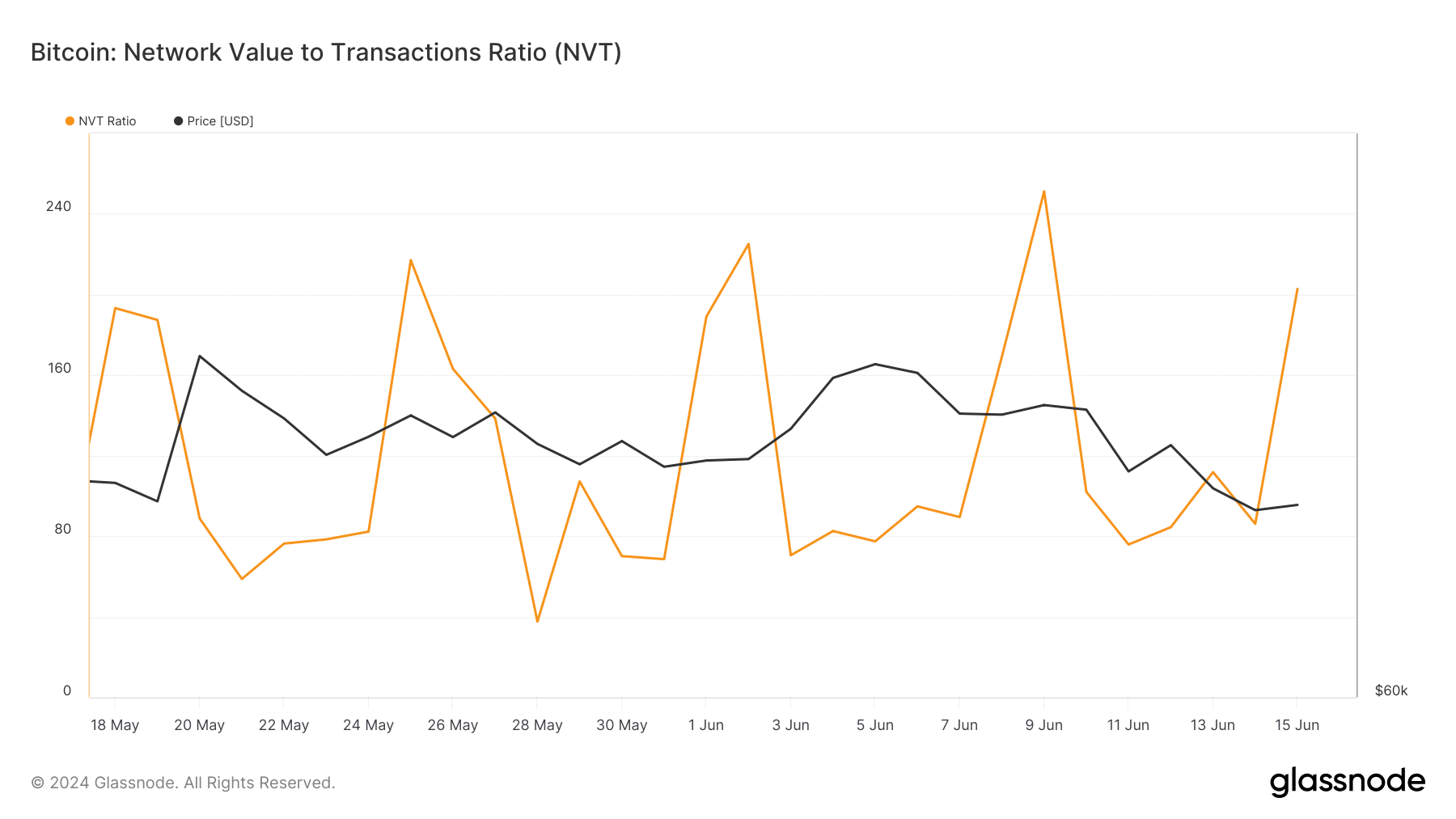

Crypto king Coinbase Premium was also in the red, meaning selling sentiment was dominant among US investors. Moreover, Bitcoin’s NVT ratio recorded a sharp rise on June 15.

A rise in the measure means that the asset is overvalued, indicating a possible price correction.

Source: Glassnode

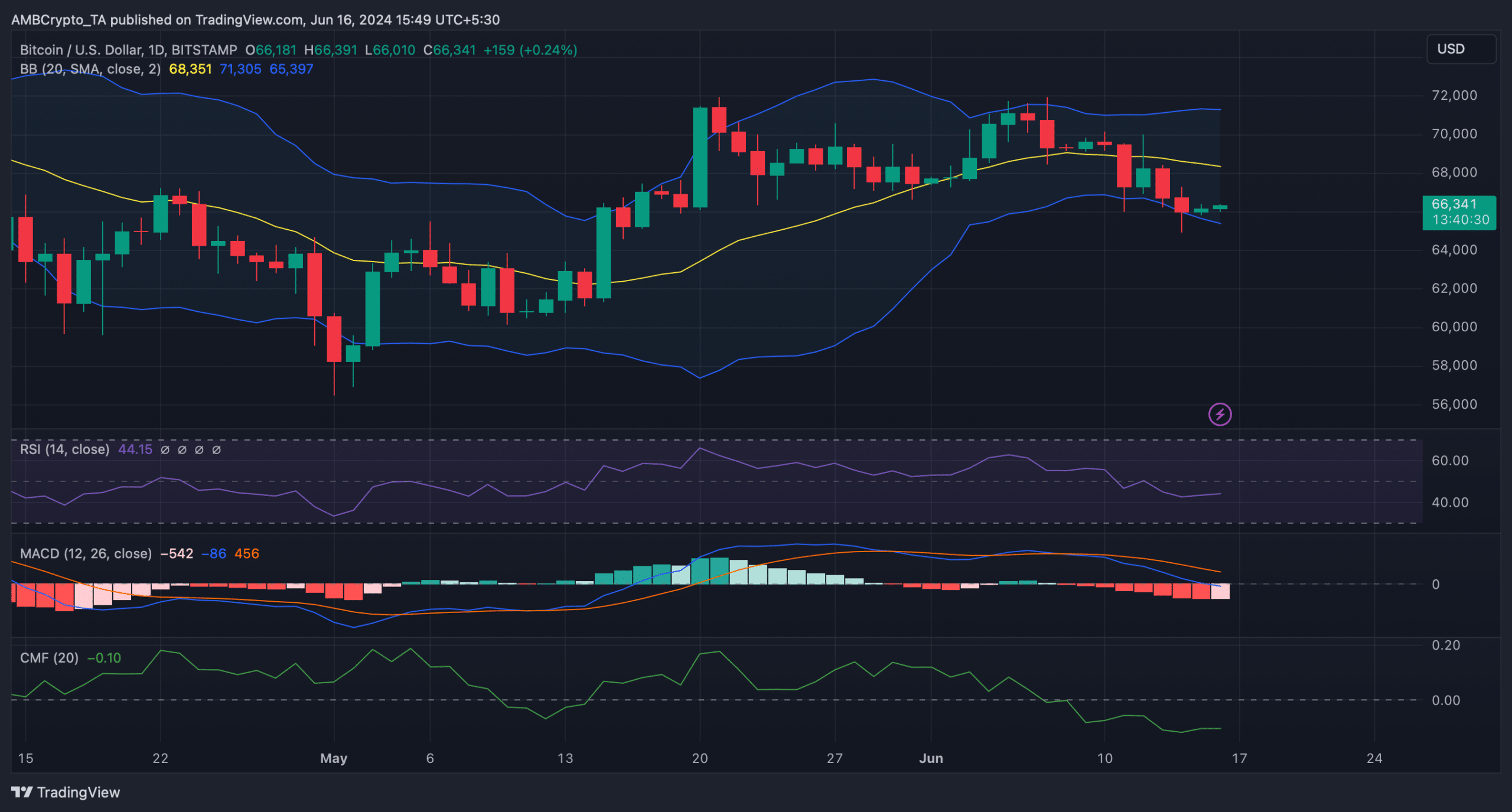

Things looked even worse, as most market indicators looked bearish. For example, the MACD indicator showed a bearish edge in the market.

Chaikin Cash Flow (CMF) registered a decline and was settling well below the neutral mark. The Relative Strength Index (RSI) for BTC was also below the neutral mark.

is reading Bitcoin [BTC] Price prediction 2024-25

These indicators indicate further decline in prices.

However, BTC price has reached the lower bound of the Bollinger Bands indicator. Whenever this happens, it indicates a recovery in prices northward in the coming days.

Source: Trading View

“Beer aficionado. Gamer. Alcohol fanatic. Evil food trailblazer. Avid bacon maven.”