- DOGE price is trading around the $0.133 price level on the charts.

- Its rising price has pushed the altcoin into an upward trend.

Dogecoin (DOGE) has seen significant gains over the past 24 hours, emerging as one of the best performing coins in the market during this period. However, that’s not all as this price surge has also led to a significant increase in the number of addresses moving into profit.

Dogecoin sees huge gains

Dogecoin daily price trend analysis revealed a massive wave of appreciation during the recent trading session.

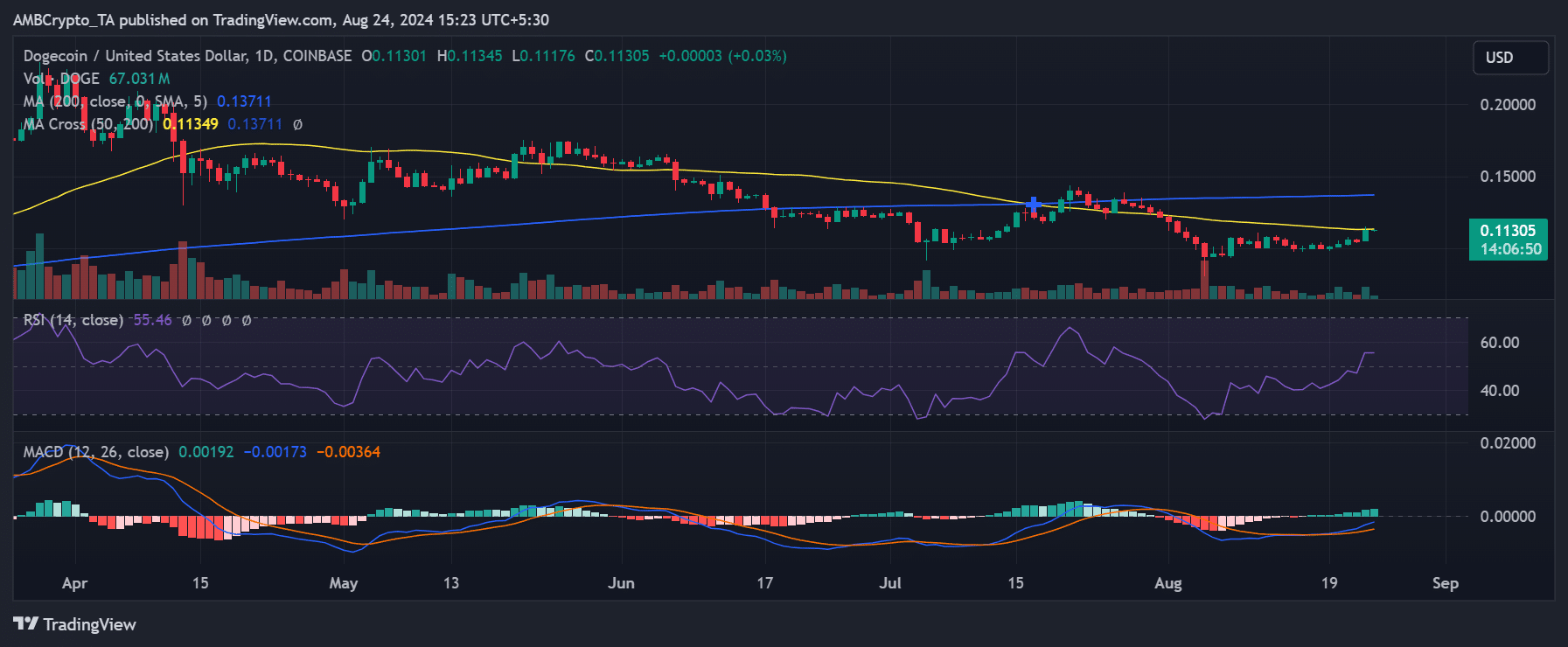

According to AMBCrypto analysis, Dogecoin is up 7.37%, reaching around $0.113. This surge has allowed Dogecoin to break through its short-term moving average (yellow line). It had previously acted as immediate resistance around its price level at the time of writing.

However, DOGE, at the time of writing, has not been able to fully break through this resistance despite this upward move. Analysis has revealed a stronger resistance level at around $0.139, which is marked by its long-term moving average (blue line).

Source: TradingView

Additionally, Dogecoin’s RSI crossed the neutral line for the first time in almost a month, recording a reading of around 55.

This move above the neutral line indicated an uptrend, indicating that momentum was building in favor of further price increases.

More Dogecoin Accounts Earn Profit

According to data from In the massThe recent price surge has led to a significant increase in the number of “profitable” or profitable Dogecoin addresses. Currently, 4.72 million addresses, representing 73.62% of all DOGE addresses, are profitable.

Meanwhile, 1.61 million addresses, or 25.04%, are “out of the money,” meaning they are holding it at a loss, while the remaining 1.34% of addresses are at breakeven.

Further analysis revealed that if DOGE can successfully break the resistance formed by its long-term moving average around $0.139, the percentage of profitable addresses could increase to around 80%.

This potential increase in profitability would boost investor confidence and could lead to additional buying pressure, pushing the price even higher. The ability to break through this key resistance level could be a crucial factor in Dogecoin’s sustained upward momentum.

DOGE is chasing TON

At the time of writing, data from Coin Market Cap Dogecoin (DOGE) is reported to have a market cap of around $16.4 billion, making it the ninth largest cryptocurrency by market cap. It currently trails Toncoin (TON), which is in eighth place with a market cap of around $17 billion.

– Is your wallet green? Check out our Dogecoin Profit Calculator

The recent surge in Dogecoin has improved DOGE’s chances of catching up with TON in the market cap rankings. However, for DOGE to overtake TON and take the eighth spot, it will need to maintain this upward momentum and continue to attract investor interest.

Sustained price increases and positive sentiment will be key factors in determining whether Dogecoin is able to close the gap and advance in the rankings.

“Beer aficionado. Gamer. Alcohol fanatic. Evil food trailblazer. Avid bacon maven.”