Biden’s senior energy adviser said the United States is still far from an international agreement to impose a price cap on Russian oil exports, with limited enthusiasm from the world’s largest energy buyers, India and China, so far.

But Amos Hochstein, President Biden’s special coordinator for international energy affairs, said he remains optimistic that Russia will eventually continue to produce despite the price limit, in large part because “their economy has nothing else.”

We are already seeing evidence in the market that Russia is selling its oil at a huge discount. So we want to put that cap on,” Hochstein told Yahoo Finance. “So we know they’re willing to sell it at a discount so they can sell it, because frankly they have cash in the bank, that’s right, but they don’t have anything else.”

Hochstein’s comments come after Russian Central Bank Governor Elvira Nabiullina said Friday that Moscow has no plans to supply crude oil to countries that choose to impose a price cap on their exports. Speaking to reporters, Nabiullina added that any Russian oil would be redirected to countries willing to “cooperate” with the country.

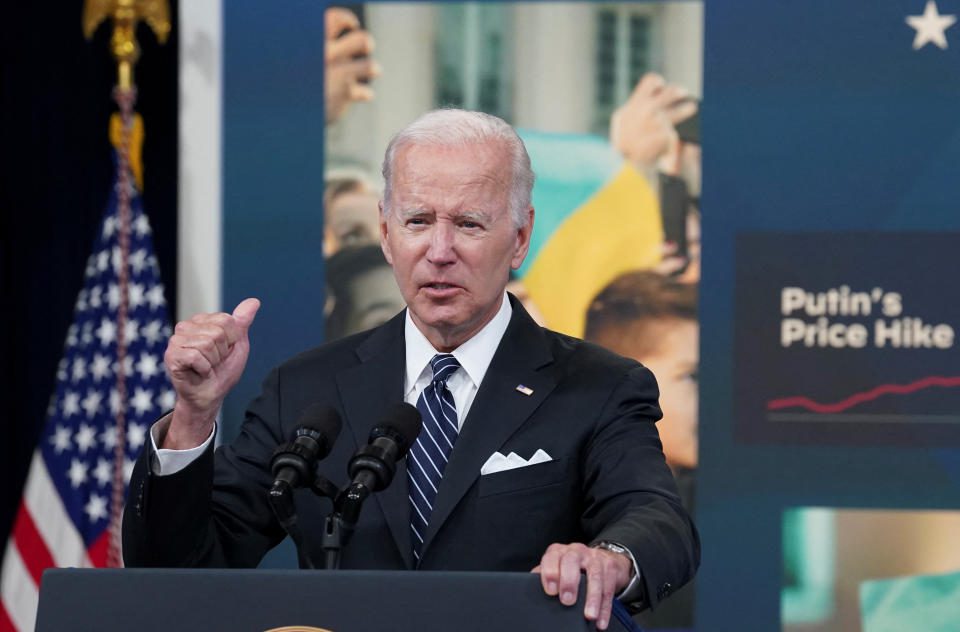

The Biden administration has proposed a price cap on Russian oil exports to limit President Vladimir Putin’s oil revenues, which Hochstein said is being used directly to fund the country’s war against Ukraine. The cap is intended to keep Russian oil prices low, without completely cutting supply, leading to a devastating rise in world oil prices.

But some EU countries that depend largely on Russian oil have been reluctant to adopt such a move. This is partly due to concerns that Putin will refuse to sell at the price and cut off Moscow’s supply altogether.

“Trying to Master the Mechanism”

Last month, the G7 countries agreed in principle to explore ways to ban “all services that allow the seaborne transportation of crude oil and Russian petroleum products globally, unless the oil is purchased at or below a price agreed upon in consultation with international partners.” Hochstein said the US has not yet settled on the details of a framework for a global price ceiling.

“We are trying to improve the mechanism of how that would actually look and how it would work. We are not at a stage where we have reached an agreement,” Hochstein said. “We have an agreement in principle with the major economies, but not an actual agreement.”

Brent crude, the global benchmark, has fallen dramatically since jumping near $140 a barrel since Russia launched its war on Ukraine earlier this year. Oil futures settled near $103 a barrel on Friday, although that still represents an increase of more than 30 percent this year.

US crude prices fell below $95 a barrel for the first time since April, Following the decision of the member states of the European Union To amend sanctions to allow Russian state-owned companies to ship to third countries.

However, critics of the administration’s proposed policy remain skeptical of its efficacy, in part because Washington has yet to receive any commitments from the world’s biggest buyers, India and China, who remain wary of disrupting their long-standing relationship with Moscow.

The plan will prevail

Since the start of the war, China has nearly doubled its imports from Russia to 1 million barrels per day, while India’s imports of Russian crude have risen 24 times to 600,000 barrels per day, according to the Eurasia Group.

Jorge Montepeque, who is credited with fixing record oil prices, ReutersPricing authorizations have been tried before and failed.

The United States attempted to fix oil prices in the 1970s, the United Kingdom attempted to stabilize foreign exchange rates in the 1980s, and Mexico attempted to stabilize tortilla prices. And then – boom! The market is stabilizing. “It’s a waste of time,” Montepeque said.

Hochstein is convinced that the economics of the plan will prevail, arguing that “every country wants to pay the lowest possible price”. He added, that Russia’s options are very limited, and will likely force Putin to come to the negotiating table.

“Their economy has nothing else. They produce weapons, they produce and they explore for oil and gas.

Akiko Fujita is a broadcaster and reporter at Yahoo Finance. Follow her on Twitter Tweet embed

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for apple or Android

Follow Yahoo Finance on TwitterAnd the FacebookAnd the InstagramAnd the FlipboardAnd the LinkedInAnd the Youtube

“Lifelong food lover. Avid beeraholic. Zombie fanatic. Passionate travel practitioner.”