The closely watched crypto strategist who accurately called the Bitcoin crash in May 2021 says he could see BTC skyrocket in the coming years.

Dave the Wave tells his 118,000 Twitter followers that based on his logarithmic growth curve (LGC) model, Bitcoin is likely to see an increase of more than 1100% over the next four years.

“Who says we don’t get something like this? The main idea in this chart is that the multi-year trend line, which crosses the LGC, acts as a *average of price.”

Looking at the chart, cryptocurrency strategist Expect Bitcoin continues to rise to $260,000 by 2026.

In addition to anticipating a May 2021 crash, the wave dev is also Call BTC capitulated to around $25,000 in April of this year when Bitcoin was trading at around $43,000. Either way, the crypto strategist I depend On the LGC model.

dave the wave Highlights That LGC has been anticipating BTC tops and bottoms since 2018.

“Well, unsurprisingly, he thought [to be conservative] In 2018 when he was first hired. This price has now tracked the height and depth of those curves for a good few years which makes it less surprising…. Although it may still be undesirable for some.”

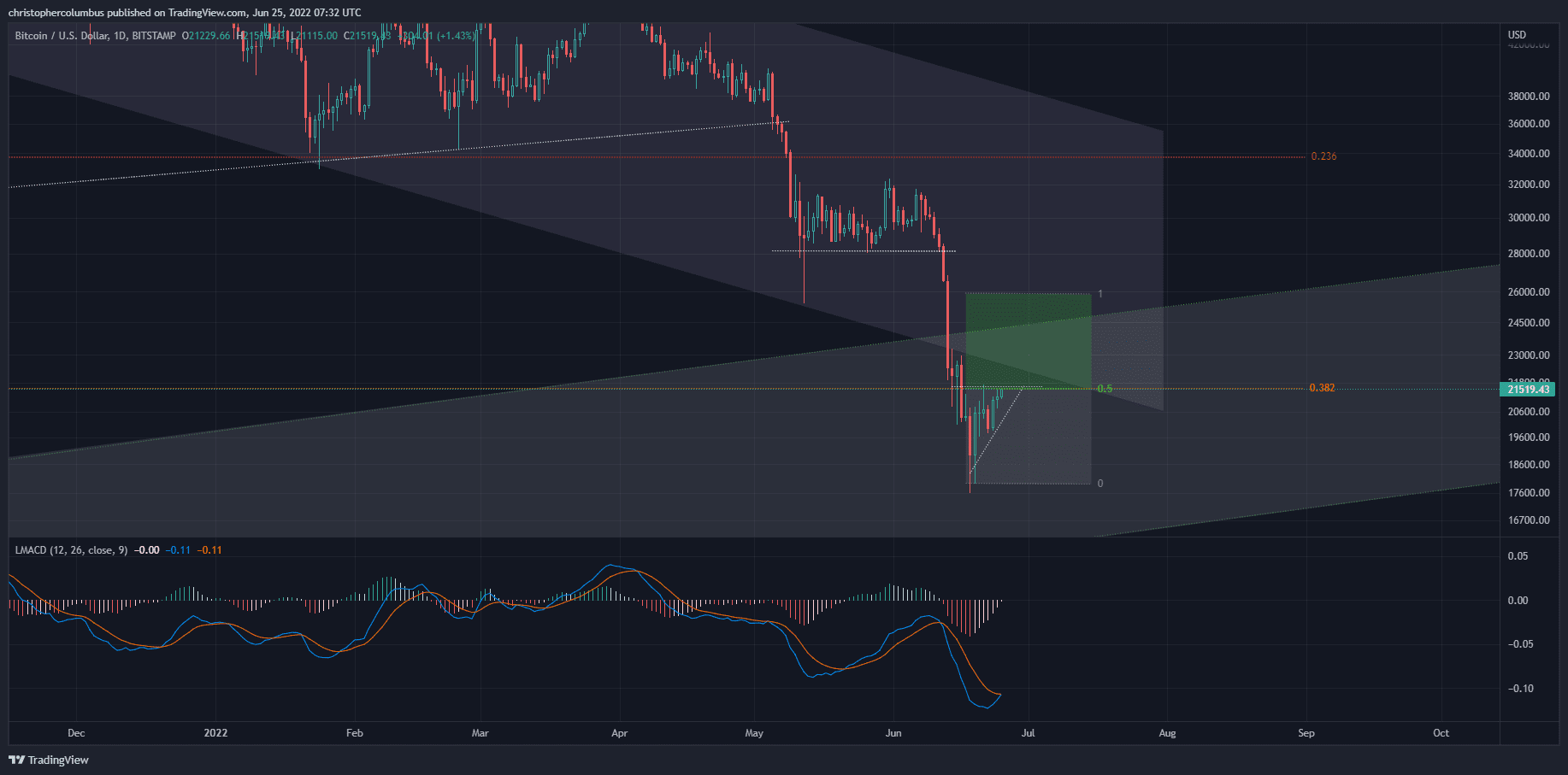

As for his short-term outlook on Bitcoin, the analyst says BTC is poised for a rally to its $25,000 target.

“Bitcoin is in the long-term buying territory of investors. Short-term technical analyst [always more specualtive] $25,000 target.

At the time of writing this report, Bitcoin Hands change at $21442, in green for less than 1% in the past day.

check price movement

Don’t miss a chance – Subscription Get encrypted email alerts delivered straight to your inbox

Follow us TwitterAnd the Facebook And the cable

browse Daily Hodel Mix

& nbsp

& nbsp

Disclaimer: The opinions expressed in The Daily Hodl are not investment advice. Investors should perform their due diligence before making any high-risk investments in bitcoin, cryptocurrency or digital assets. Please be aware that your transfers and transactions are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend buying or selling any cryptocurrency or digital assets, and The Daily Hodl is not an investment advisor. Please note that The Daily Hodl is involved in affiliate marketing.

Featured image: Shutterstock / Liu zishan / Natalia Siiatovskaia

“Beer aficionado. Gamer. Alcohol fanatic. Evil food trailblazer. Avid bacon maven.”