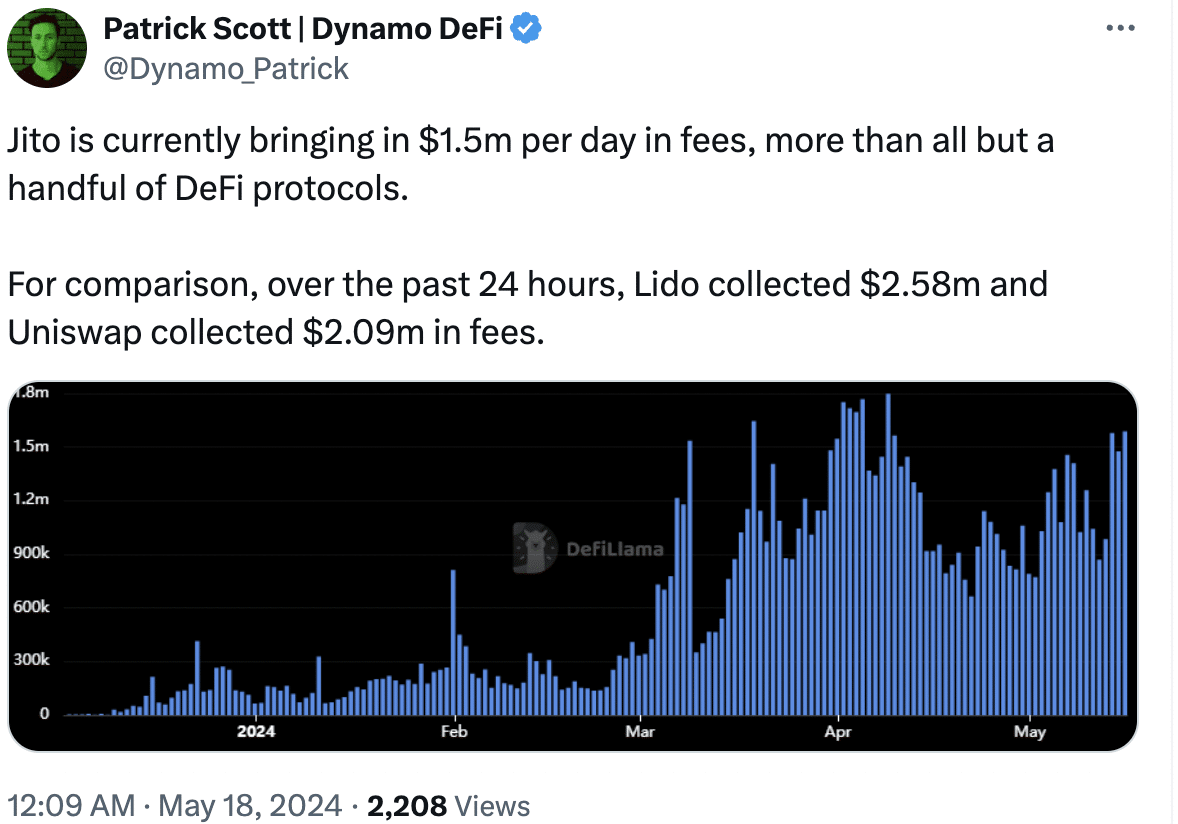

- Jito has collected significant amounts of daily fees, outpacing the vast majority of DeFi protocols.

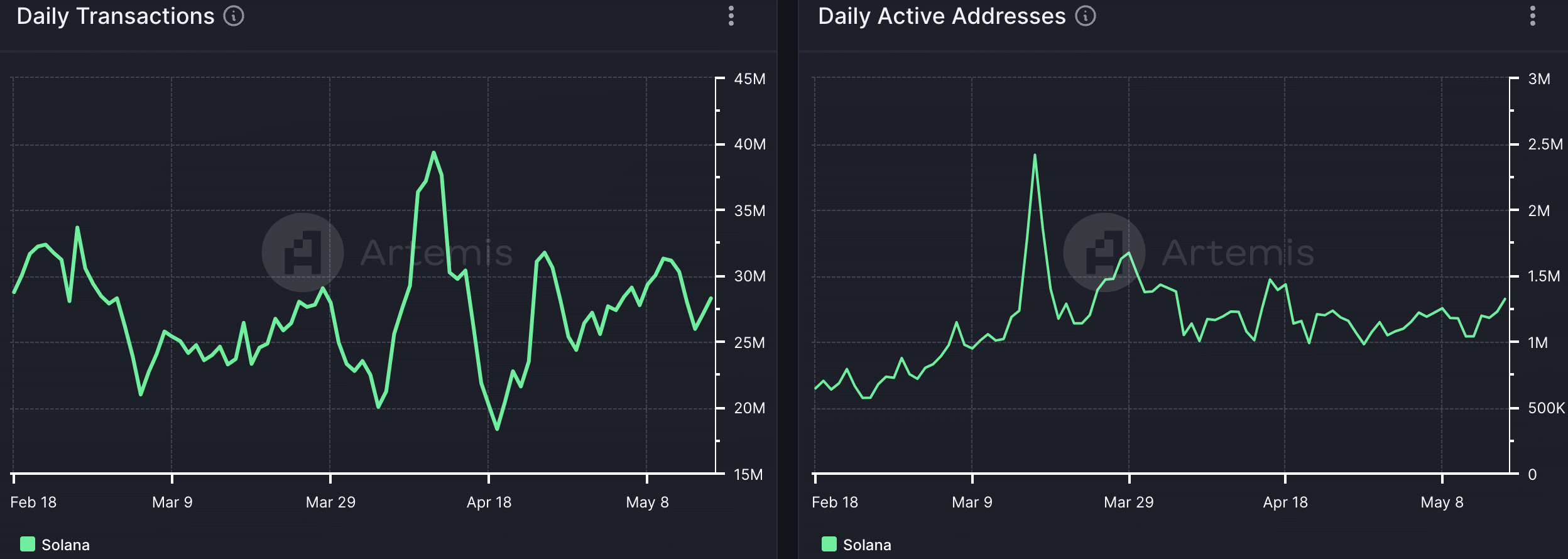

- The Solana ecosystem has continued to see growth with high activity on the network.

Solana [SOL] It has managed to attract many users to its ecosystem over the past few months. Primarily, this growth in activity was initiated by the attraction of memecoins into the network.

Jeeto shows growth

However, other elements of the Solana ecosystem have also seen growth over the past few days. One of them was the Ghetto Protocol.

At press time, Jito was generating $1.5 million in daily fees, outpacing all but a few DeFi protocols. For comparison, Lido raised $2.58 million and Uniswap collected $2.09 million in fees over the past 24 hours.

Gito’s success has several potential implications for Solana. First, it illustrates Solana’s growing DeFi scene.

Jito’s ability to compete with established DeFi giants like Uniswap and Lido demonstrates the Solana ecosystem’s ability to create highly competitive dApps.

This could attract more developers and users to the platform, further accelerating the growth of DeFi within the Solana ecosystem.

Second, high Jito fees indicate a healthy level of network activity on Solana. This activity could translate into increased network security and potentially higher value for SOL in the near future.

However, a large portion of Jito’s fees are derived from MEV (Maximum Extractable Value), which can sometimes lead to negative user experiences such as sandwich attacks.

Solana will need to find ways to mitigate these potential disadvantages to ensure sustainable growth. Overall, Gito’s performance is a positive sign for Solana.

Source: X

Regarding the overall activity on the Solana network, a huge increase has been observed. The number of daily transactions taking place on the network increased from 17 million to 28 million over the past week.

In addition, the number of daily active addresses on the network increased from 1 million to 1.5 million during the same period.

Source: Artemis

Seoul State

At press time, SOL was trading at $174.67, and its price was up 3.80% in the past 24 hours.

Is your wallet green? Check out the SOL Profit Calculator

The CMF (Chaikin Money Flow) has risen significantly over the same period, indicating that money flowing into SOL has increased.

However, the Relative Strength Index (RSI) has reached overbought territory, which could indicate that a correction could be on SOL’s way in the future.

Source: Trading Offer

“Beer aficionado. Gamer. Alcohol fanatic. Evil food trailblazer. Avid bacon maven.”