- Bitcoin fell by about 3% after rising to a local high of $69.4K.

- Bitcoin dominance and liquidity charts provide clues about the next price move.

Bitcoin [BTC] It reached the resistance area at $69,000. In a previous report, it was highlighted that the liquidity pool at this level is likely to attract prices towards it before a possible bearish reversal.

Over the past 24 hours of trading, Bitcoin has reached $69.4K and is down 2.7% to trade at $67.5K at the time of writing. The metrics were bearish in the short term earlier this week. Monday’s trading session could set the tone for the week ahead.

Possible scenarios for Bitcoin this week

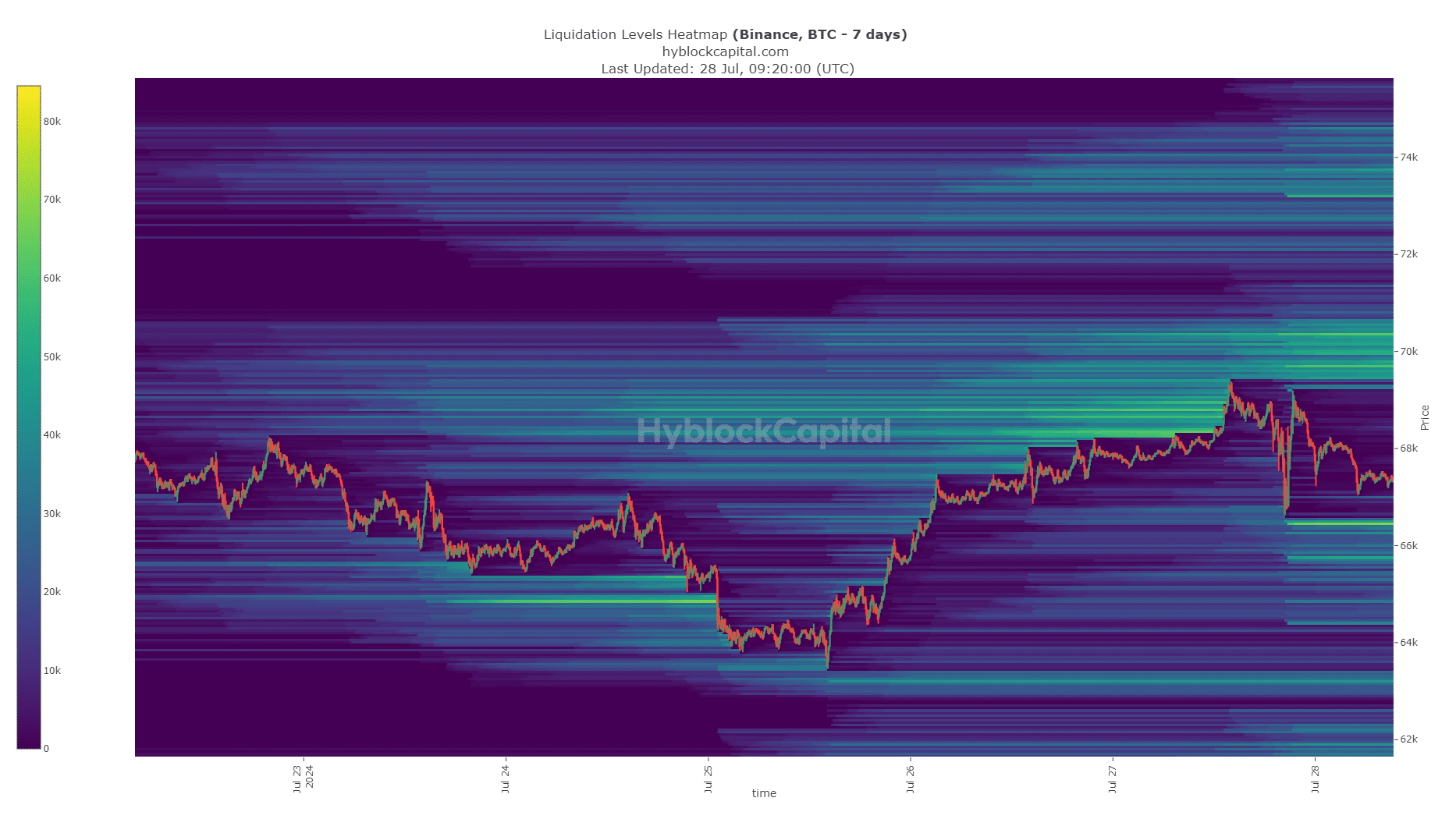

source: Highblock

AMBCrypto analyzed the 7-day review period on the liquidation heatmap. There was a cluster of liquidation levels around the $70k level and the $66.4k level.

Over the past few hours, the price reversal from the $69K area helped add more liquidity to the liquidity pool at around $70K.

This makes Bitcoin an interesting target on Monday. A move towards the $70,000 area will attract liquidity and create hope among bulls before a reversal occurs.

This price surge could precede a drop to $66.4K. A move beyond either level would likely indicate whether this week will be bullish or bearish.

Evidence from the Dominance Scheme

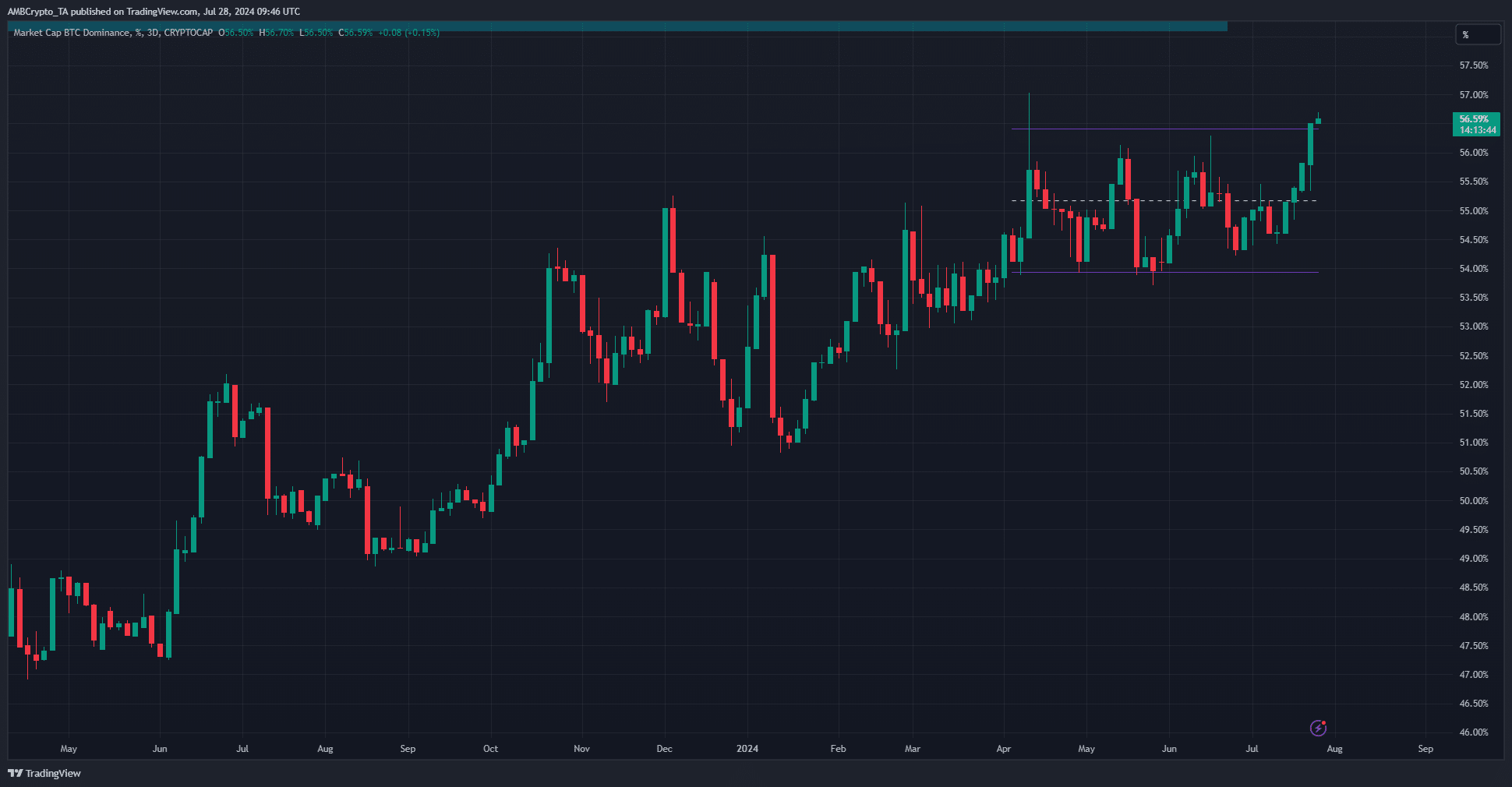

Source: BTC.D on TradingView

The Bitcoin dominance chart showed a breakout above the range highs. This means that Bitcoin has been outperforming major altcoins. In the event of a market-wide recession, altcoins will suffer disproportionately.

Traders can use this information to determine which assets to trade based on Monday’s trend signals.

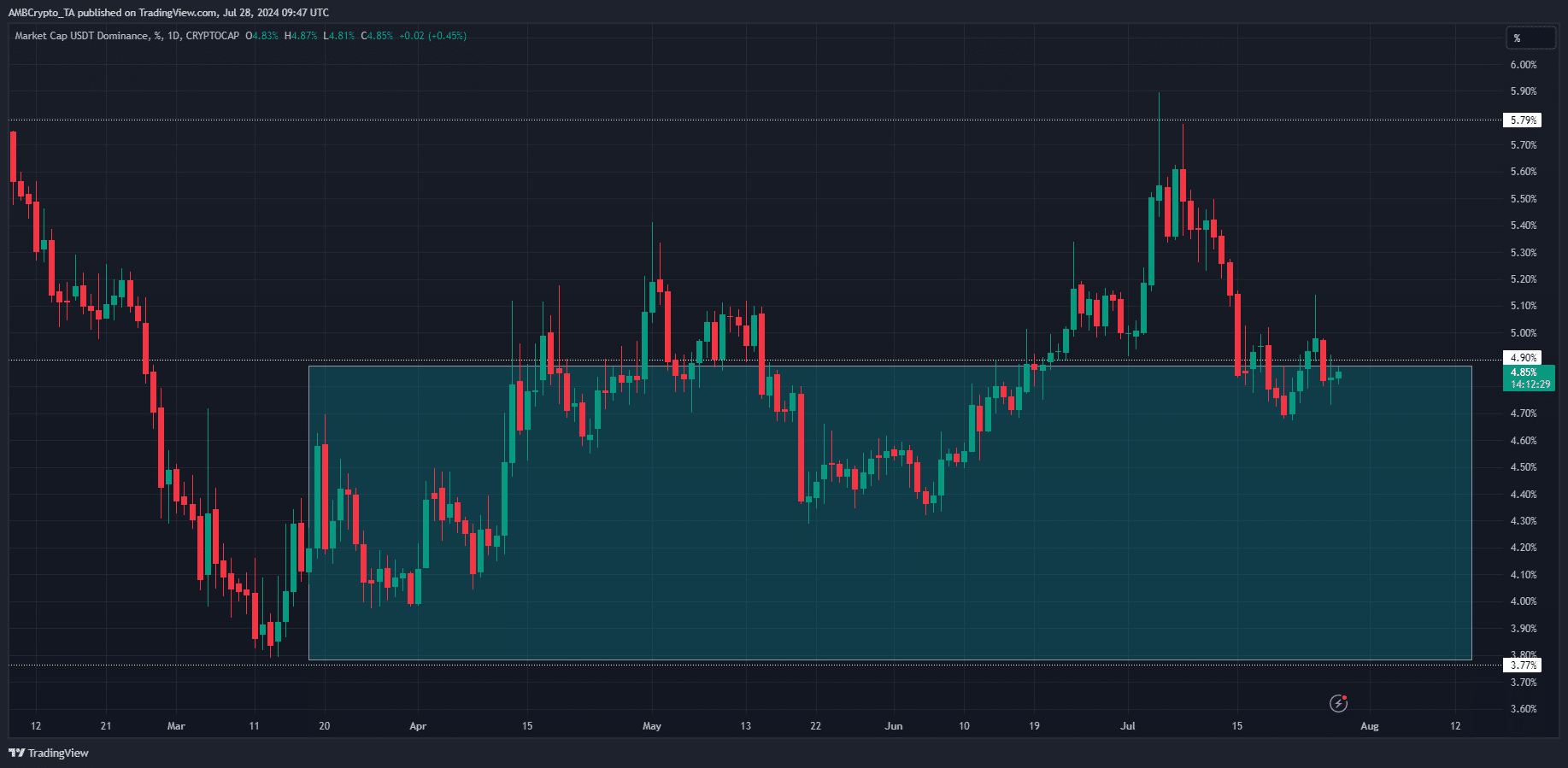

Source: USDT.D on TradingView

Tether’s dominance chart is inversely correlated with cryptocurrency market price movements. When the price of USDT.D rises, it is a sign that investors are moving to stablecoins and selling their cryptocurrencies.

Read about Bitcoin [BTC] Price forecast 2024-2025

Depending on the trend of Tether dominance, a bearish move could occur this week. Traders can closely monitor Monday’s performance and build their directional bias accordingly.

Over the past month, the USDT.D pair’s movement on Monday has generally set the tone for the week ahead.

“Beer aficionado. Gamer. Alcohol fanatic. Evil food trailblazer. Avid bacon maven.”