Bitcoin (BTCIt failed to recoup the latest losses on July 2 as traders brace for a continuation of the stagnant price action.

“Accelerating downward trend” is still in effect

info from Cointelegraph Markets Pro And the TradingView BTC/USD tracked poorly as it cut around the $19,000 mark over the weekend.

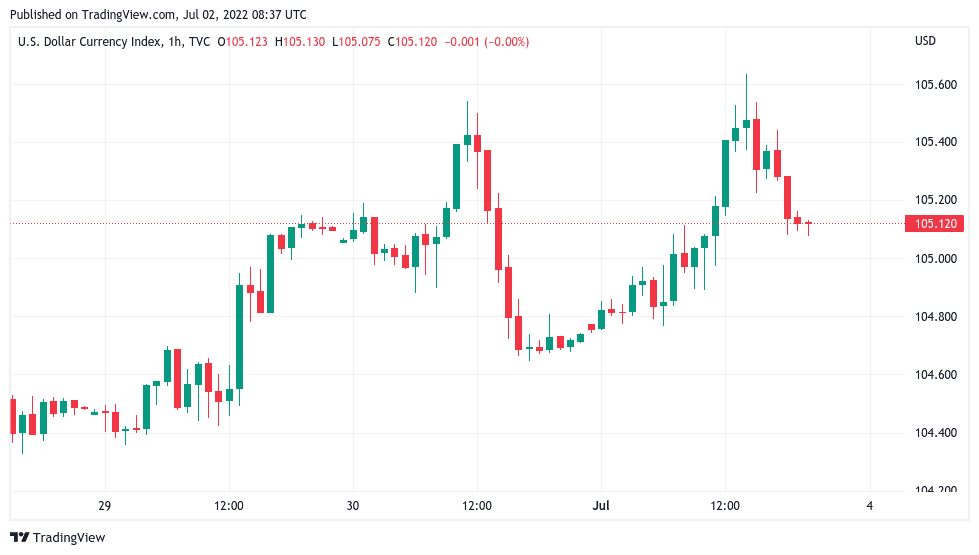

The trading week on Wall Street ended without surprises, with US stocks practically stagnating – providing little impetus to cryptocurrency volatility. US Dollar Index, or DXY, New from A exam REPETITON From its twenty-year high, it ran out of steam to surround 105 points.

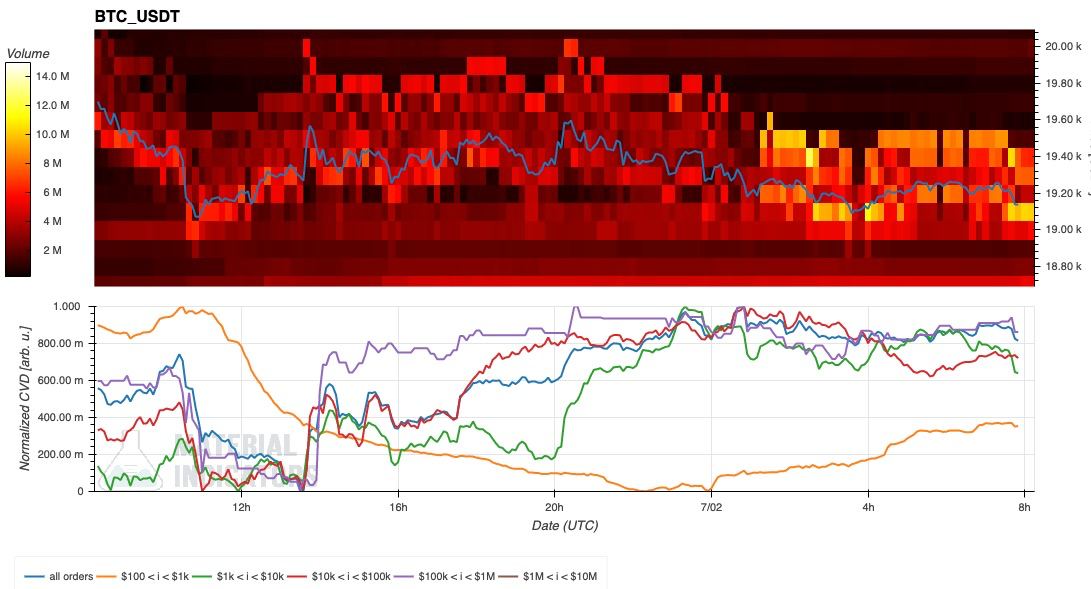

Order history data from the world’s largest exchange Binance showed that Bitcoin/USD is stuck between buying and selling liquidity near the spot price, ensuring there is no volatility until traders maneuver or add significantly to bids or orders.

Zooming out, the outlook hardly seemed more optimistic for the bulls.

For the popular Altcoin Sherpa trading account, the current conditions promised an extended period of uninspired performance from Bitcoin that could run into 2022.

“It will take months to chip away and pile up once the bottom is found.” Tell Twitter followers.

“And the bottom may not come even for a few more months from today. IMO beware of a long bear market.”

The sentiment was echoed by trader and analyst Rekt Capital, who argued that Bitcoin had not yet reached new macro lows or started to consolidate.

#BTC It may still be in the correction phase to “accelerate the downtrend”

But this stage will precede the stage of “multi-month consolidation”

Which will precede the “New Macro Update” phase.BTC dollars # encrypt # bitcoin

– Rektcapital July 1, 2022

“Taste yourself. Get your Bitcoin in cold storage. Sit well,” Checkmate, lead chain analyst at research firm Glassnode added.

Will Volume Rise Ever Be Echo of 2018?

The next week or two could be the lowest in this cycle, and at the same time, it offers a degree of hope for those worried that the bottom is still months away.

Related: Price Analysis 7/1: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, LEO, SHIB

in Twitter theme On that day, economist, trader and entrepreneur Alex Krueger noted that the volume denominated in bitcoin hit an all-time high last month.

“As a rule of thumb, trading volume is highest when markets give up,” he explained.

As a general rule, volume is highest when markets give up, and that capitulation creates major bottoms.

This weekly chart includes aggregate bitcoin volume for most bitcoin pairs (instant and perpetual across exchanges).

Trading volume reached an all-time high two weeks ago. pic.twitter.com/6ONLibQiL2

– Alex Kruger (@krugermacro) 2 July 2022

He added that in the 2018 bear market, the all-time highest volume actually occurred several weeks before the price bottom, and if this time follows the trend, July could be the location of the next day.

Previously, Rekt Capital . had argue Buy-side volume wasn’t strong enough to sustain the new price hike in the long run, while also Highlight volume moves 2018.

The opinions and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should do your own research when making a decision.

“Beer aficionado. Gamer. Alcohol fanatic. Evil food trailblazer. Avid bacon maven.”