Goodbye cool, hello Gemini. last week, Alphabet (NASDAQ:GOOGL) She provided an update on her LLM (Large Language Model) endeavors, which included rebranding her automated chatbot from Bard to Gemini. In the same vein as OpenAI competitor ChatGPT, the company will now offer a tiered subscription service for the bot.

The updated Gemini will offer different levels of service, ranging from the basic free option to the high-level Ultra 1.0 package at $19.99 per month. Google states that the Ultra version, which uses the Gemini Advanced AI model, will excel at complex tasks like programming, creative teamwork, and logical analysis, and says its unique levels and models will set it apart from competitors. By the company's standards, Gemini exceeded GPT-4V (GPT-4 with Vision) on various levels, including college-level reasoning problems, optical character recognition, document understanding, speech recognition, and more.

The robot will also be available through a standalone Android app called Gemini and is scheduled to be accessible through the standard Google app on iOS in the coming weeks. Bard is already accessible in 40 languages via web browsers, albeit exclusively for users who have Google Labs functionality enabled.

The latest update offers a lot of good news for investors, says John Blackledge, a 5-star TD Cowen analyst. “Net-net, we're encouraged by GOOG's announcement, especially because we believe the new offering of its Gemini-based paid subscription product (Google One AI Premium) supports the idea that GOOG is confident enough in the quality of its output to charge consumers a monthly fee,” Blackledge said. ,OpenAI and Microsoft already offer several subscription-based services that include access to OpenAI's GPT-4 LLM.

Gemini's capabilities were initially showcased in an announcement in December 2023. At the same time, the company emphasized its commitment to safe and responsible development. Aside from incorporating classifiers to screen for malicious content, Google also collaborated with third parties to thoroughly test the model. “This aligns with GOOG's commitment to responsible deployment of AI,” says Blackledge. “From our perspective, this is a key theme underscoring GOOG's cautious rollout of GenAI products in '23.”

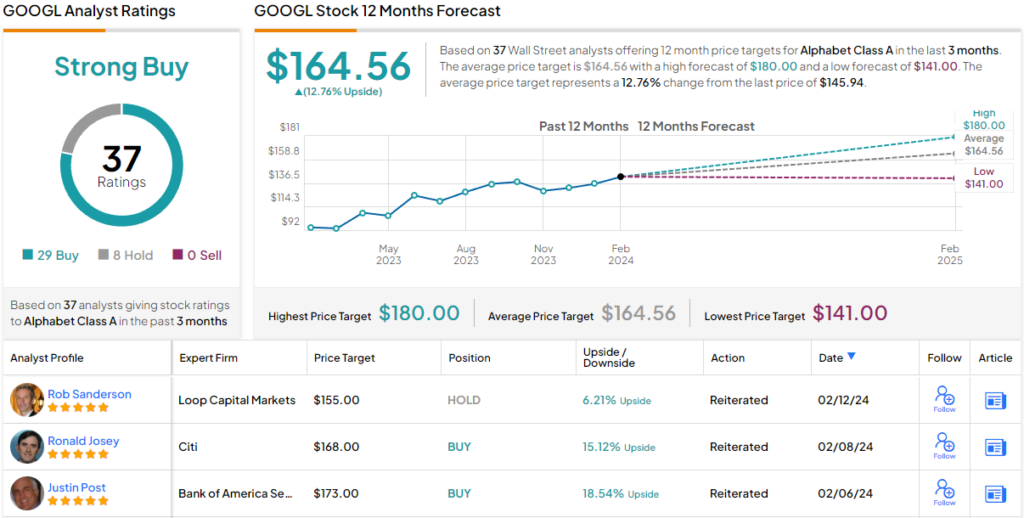

Finally, Blackledge reiterated an Outperform (i.e. Buy) rating on GOOGL stock in line with its $165 price target. This figure results in 12-month growth of 12% from current levels. (To view Blackledge's track record, click here)

Blackledge's goal closely mirrors that of the Street; The average target is currently $164.56 and represents an upside of approximately 13%. In terms of rating, based on a mix of 29 Buys versus 8 Holds, the stock has a Strong Buy consensus rating. (be seen Alphabet stock forecasts)

To find good stock trading ideas at attractive valuations, visit TipRanks' Best Stocks to Buy, a tool that unites all of TipRanks' equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

“Freelance web ninja. Wannabe communicator. Amateur tv aficionado. Twitter practitioner. Extreme music evangelist. Internet fanatic.”