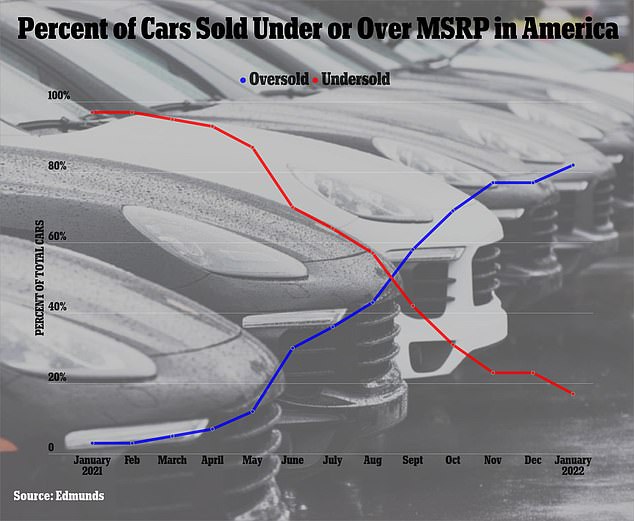

Four-fifths of Americans who bought a car from a dealership last year paid more than the sticker price — a 276-fold increase in just two years.

A new study from auto market research firm Edmunds shows that only 3 percent of cars purchased from U.S. dealerships were sold at the Manufacturers Suggested Retail Price (MSRP) at the beginning of 2021.

The trend slowly picked up by May before picking up to 82 percent in January 2022, a 276-fold increase from 0.3 percent in 2020.

Ford saw an average of an additional $163 for its MSRP in 2021, even though one Seattle woman told The Washington Post she was warned she would have to pay $12,000 above the list price for one of the company’s hybrid pickup trucks, causing Pay her to give up on the purchase.

GM’s Chevrolet and GMC brands saw price margins of $625 and $677, respectively.

GMC’s prestigious Cadillac line saw an average of $4,048 last month. Kia, the brand famous for its Hyundai deal, saw an average rise of $2,289.

On average, the new car price cost consumers an additional $728, with shoppers reporting electric and hybrid cars selling for an additional $10,000 or more.

Only about 3 percent of cars sold at dealerships were coded at the beginning of 2021. By January 2022, 82 percent of cars sold were coded.

Ford saw an average of an additional $163 for its MSRP in 2021, with some popular models, such as the Maverick (above) coded as high as $12,000.

GM’s Chevrolet and GMC brands saw price margins of $625 and $677, respectively. It’s the Cadillac line that has seen an average of $4,048 in the last month

Ford said it will prevent delivery of its most popular vehicles, including the new F-150 Lightning pickup and other electric vehicles, from dealerships that overcharge cars.

Ford spokesman Saeed Deeb told Washington Post That the company is concerned about how the brands will affect their new electric and hybrid vehicles as they try to compete with Tesla, which leads the market in electric vehicles.

“Lightning is a huge problem for us,” Depp said. “It is a leap forward in innovation for any of our trucks. It plays a critical role for our brand and all of our dealers.”

Ford CEO Jim Farley told investors at a conference in January that about 10 percent of the company’s roughly 3,000 dealerships in the United States were consistently seeking cars above their MSRP in 2021.

GM did not immediately respond to a DailyMail.com request for comment.

Hyundai said it is “constantly reminding its dealers of the need for full transparency” on pricing and “strongly promoting it.”[s]That the prices advertised online for vehicles must correspond to the retail prices.

“We strongly discourage our merchants from charging higher MSRP prices,” the company said in a statement.

Vintage car manufacturers in the United States are bound by laws that force them to sell vehicles through dealerships, with these mean men and women adding to the profit from the sale.

Newer companies including Tesla and Rivian sell directly to customers, which lowers that price. Older brands are now keen to follow suit, although they are said to be aware that they risk losing the knowledge and skill of the merchants closing sales to them.

Hyundai saw its popular brand Kia deal coded at an average of $2,289

Ford is concerned that the increase in branding will damage the company’s reputation and launch its new line of electric cars to complement the Tesla models (pictured)

Ford estimated that about 10 percent of the company’s 3,000 dealerships in the United States were consistently seeking vehicles above MSRP in 2021.

David Eagle, a Los Angeles-based auto broker who helps shoppers negotiate prices for electric and hybrid cars, told The Post he’s had trouble finding good prices for his customers in the past year.

He said the market suffered greatly at the start of the pandemic in 2020 as dealers sat on cars for months on end before people started buying cars again in 2021, with 15 million cars sold last year, up slightly from the 14.6 million cars sold in 2021. 2020.

Eagle added that dealers are also raising prices to counteract supply shortages as a shortage of microchips has hampered auto manufacturers.

Jeff Iossa, who owns a Mercedes-Benz dealership in New London, Connecticut, told the newspaper that dealers don’t have much choice but to mark up cars amid lower sales.

“I think a lot of high-end luxury buyers realize that, ‘Look, your volumes are low and you’re always discounting historically,'” Ayusa said.

“If we now need to pay a little extra for something we want and need now, we understand that’s the environment we live in. And you have to stay at work, and we want you to stay because we don’t want to come back and see the lights out and we can’t service our car.”

“Beer aficionado. Gamer. Alcohol fanatic. Evil food trailblazer. Avid bacon maven.”