- The 50% retracement level and daily RSI indicated a possible range formation.

- The high buying pressure and the liquidation heat map gave conflicting signals.

baby [PEPE] Cryptocurrency memecoin struggled to break the local resistance level. The cryptocurrency showed signs of forming a range, but a bullish chart pattern is also a viable scenario, according to a previous report by AMBCrypto.

The report added that on-chain metrics showed that selling pressure could increase in the coming days.

To find out the most likely path for PEPE, the liquidation levels data was investigated along with technical analysis.

Long term key Fibonacci retracement level defended

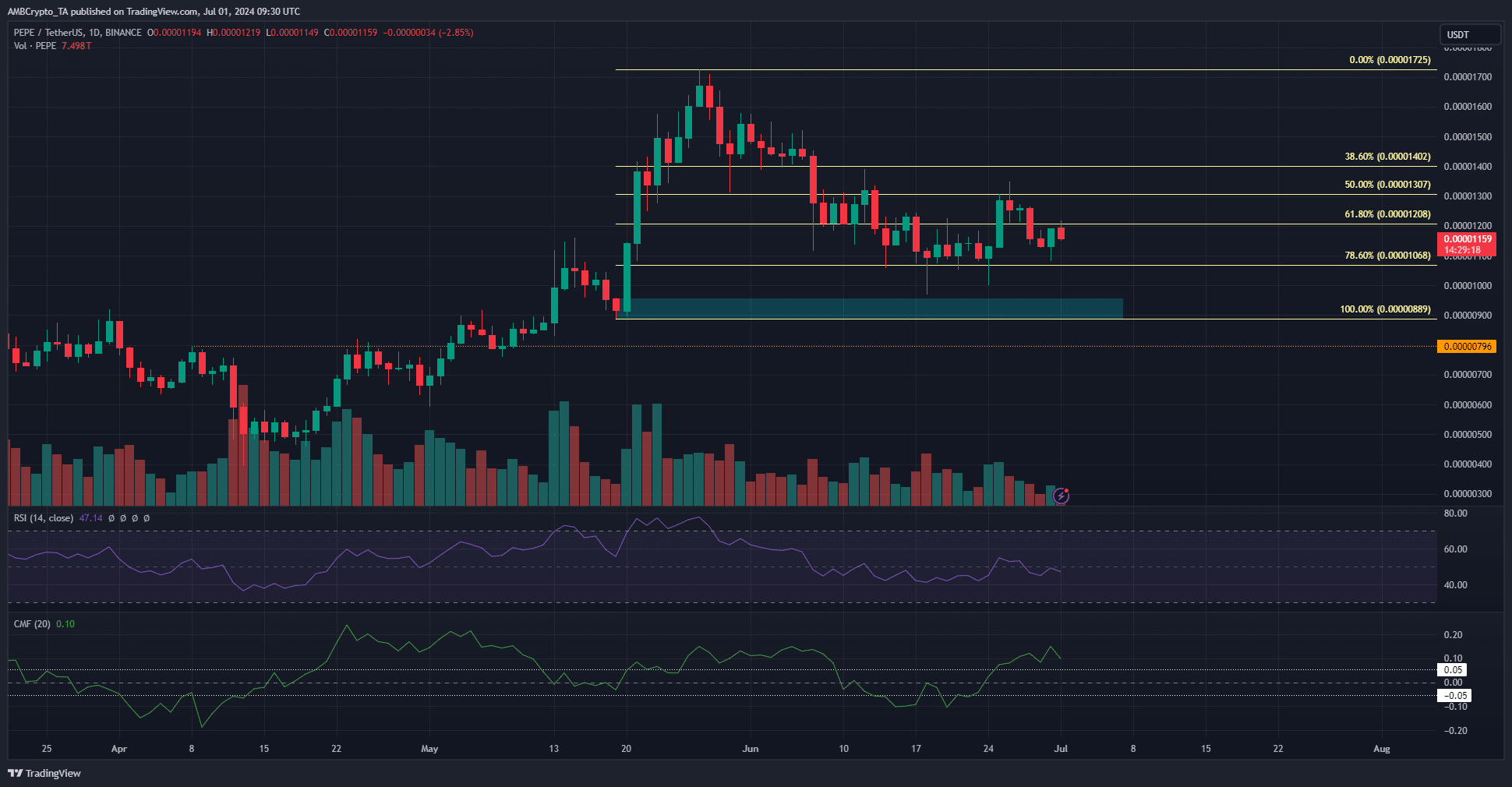

Source: PEPE/USDT on TradingView

During the downturn in the second half of May, selling pressure began to intensify. In mid-June, the stock market index fell below -0.05, indicating massive capital outflows.

At the time, PEPE prices were expected to reverse their entire bullish trajectory in mid-May and drop to $0.0000089.

The bulls made sure that this did not happen and bravely defended the 78.6% retracement level at $0.0000107. However, they were not strong enough to force the price to break beyond the 50% retracement level at $0.000013.

The main market index also returned to the +0.05 level, but the daily RSI was slow. It hovered around the neutral 50 level and has not yet indicated an upward shift in momentum.

Should traders prepare for another PEPE price drop?

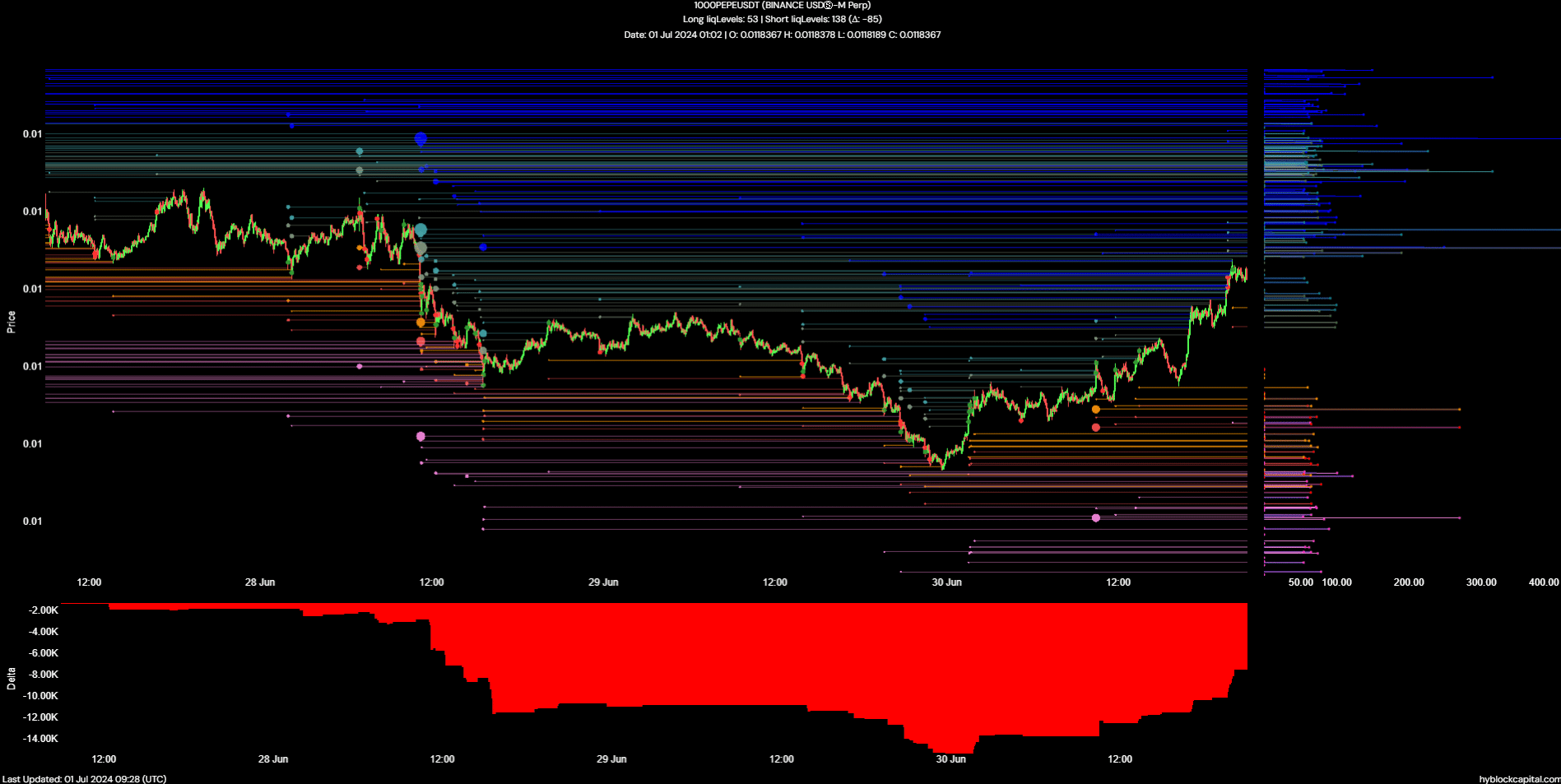

source: Highblock

The liquidation heatmap data for the past three months has indicated that the $0.000008 – $0.000009 region has a large range of liquidation levels.

They managed to attract prices to them like a magnet, especially since the 50% Fibonacci retracement level continued to act as a strong barrier.

Not every liquidity pool is guaranteed to be visited. If the bulls prove their presence in the coming weeks, the $0.000018 area will be the next liquidity target.

source: Highblock

Whether it’s real or not, here’s the market cap of PEPE in terms of BTC

Liquidation levels over the past two days have shown that the number of short positions far exceeded the number of long positions. This means that a price rebound to squeeze these short positions is likely.

The next major short-term liquidity pockets are located at $0.0000122 and $0.0000134.

Disclaimer: The information provided does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.

“Beer aficionado. Gamer. Alcohol fanatic. Evil food trailblazer. Avid bacon maven.”