nvidia (Nasdaq: NVDA) was one of The best performing stocks globally over the past 18 months. The chip maker's shares rose nearly 7-fold during this period. This exceptional growth may certainly turn off some investors, making them think it is overvalued. However, it's worth noting that momentum can actually be one of the best indicators of a stock's future performance, especially if the company has a track record of exceeding expectations.

Personally, I remain bullish on NVDA stock, not just because of the momentum but because the company is playing a pivotal role in the AI revolution, which is just getting started.

Artificial Intelligence Kingpin

Nvidia, as a company, is at the heart of the AI revolution due to its graphics processing units (GPUs), which have the capabilities required for massive AI and large language models. The units were originally designed for the gaming sector, but GPUs are also ideal for the big data processing needs of AI.

Unlike central processing units (CPUs) that handle tasks one at a time, GPUs excel at parallel processing, allowing them to handle multiple tasks simultaneously. Without this technology, the step forward we have seen in artificial intelligence, which includes advances in facial recognition technology and self-driving cars, would not be possible.

Nvidia's dominance stems from its graphics processing unit (GPU) architecture. Unlike CPUs that have just a few cores, Nvidia packs a massive number of cores into a single chip. This in turn allows high processing power within a smaller space, which is extremely important for efficient AI processing. Furthermore, NVIDIA has focused on high-bandwidth memory, which allows these cores to access data quickly, further accelerating AI calculations. As such, Nvidia has gained a huge advantage in the AI hardware race.

However, in the world of AI, it's not just about the hardware. Nvidia's CUDA software provides direct access to the GPU's virtual instructions. This software ecosystem empowers developers to create and improve AI projects, and has made Nvidia a one-stop-shop for all things AI.

Isn't Nvidia really expensive?

Nvidia stock is expensive because it has become less expensive for many investors. At around $900 a share, some investors may have a hard time buying a single Nvidia share as part of a diversified portfolio of collectibles. However, from a valuation perspective, I don't think Nvidia stock is expensive or overvalued. In fact, it may still represent good value.

Nvidia currently trades at 35.4 times forward earnings, making it more expensive than the S&P 500 (SPX), but it is by no means expensive for the technology sector. Moreover, the company is expected to continue to achieve excellent growth in the medium term. In fact, Nvidia's earnings are expected to grow 34.78% annually over the medium term.

This means that Nvidia's all-important PEG ratio is 1.02. While 1.0 could be considered a fair value benchmark, I still think this represents good value, noting the long-term trends in the AI industry and the market's bullishness on US technology.

This in turn means that Nvidia is trading at 29.77 times earnings for 2026, 25.26 times 2027, and 21.49 times 2028. Furthermore, it's worth noting that Nvidia continues to beat even the most optimistic analysts' expectations. This is always a good sign, and it may continue to exceed expectations in the future.

Is NVDA stock a buy according to analysts?

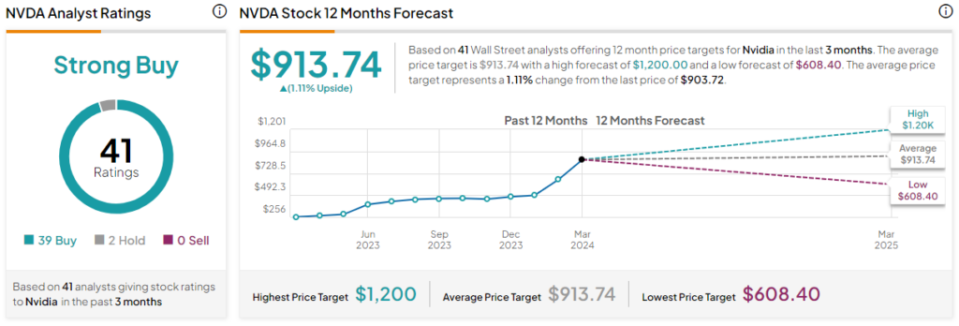

Given its enabling position in the AI revolution and attractive valuation metrics, Nvidia stock has received a strong buy from analysts. Currently, Nvidia has 39 Buy, 2 Hold ratings, and zero Sell ratings. the Average price target for Nvidia stock It is $913.74, indicating a potential upside of 1.1%. The highest price target for the stock is $1,200, and the lowest price target for the stock is $608.40.

Bottom line

Nvidia has been central to the AI revolution, but there are two important things to consider moving forward: Nvidia's competitive advantage in the all-important generative AI market and the fact that the AI revolution has only just begun.

Over the past 18 months, Nvidia has found itself facing a massive moat, upon which it has successfully built. Other companies, including Intel (NASDAQ:INTEC), have their sights set on Nvidia's crown, but it's not clear how they'll catch up. The Santa Clara-based company's new H200 chipset is essential for generative AI and large language models. The H200 is thought to be between 1.4 and 1.9 times faster than the H100 when it comes to large language model inference. This is an impressive jump in just one year.

Moreover, the market is growing and has the potential to grow much faster. softbank (OTC:SFTP) Masayoshi Jr. is Consider a $100 billion project in the field of artificial intelligence chipsOpenAI's Sam Altman is said to be looking for a $7 trillion series of AI chip factories that would respond to growing demand and restructure the world's semiconductor sector.

Given the near-term momentum in this sector, the fact that demand for GPUs continues to outpace supply, and the fact that we are truly at the beginning of the AI revolution, I remain bullish on Nvidia.

“Beer aficionado. Gamer. Alcohol fanatic. Evil food trailblazer. Avid bacon maven.”