CNBC’s Jim Cramer warned investors Friday that the stock market is unlikely to recover any time soon.

“The charts, as interpreted by Mark Sebastian… indicate that this market is getting more bearish, and it’s too early to really go up,” he said.

Related investment news

“Unlike him, I also think we could make a sharp rally, but for our charitable fund, if that happens, we’re going to have to do some selling,” he added.

The S&P 500 closed Friday in its worst month since March 2020. The Dow Jones Industrial Average was down 8.8% during the month, while the Nasdaq Composite was down 10.5%.

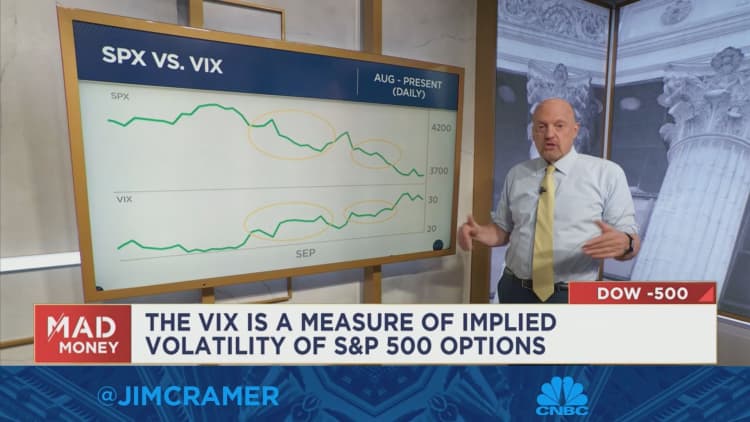

Before getting into Sebastian’s analysis, Cramer first explained that when the S&P 500 goes down, the CBOE Volatility Index, also known as the VIX or Fear Scale, usually moves higher. And when the S&P moves higher, the VIX usually goes down.

Then he examined a pair of charts showing the daily movement in S&P and VIX:

While S&P and VIX moved at the same pace in June, things took a turn in August. Sebastian points out that when the S&P began falling in late August, the VIX was seeing a “slow rally” rather than roaring as it usually does, according to Kramer.

Cramer said the mismatch in the action between the moves of the S&P and VIX persisted into early September, but it actually exploded this week, adding that the market is still far from recovering.

“Sebastian is waiting for the S&P to go down while the VIX goes down too – this is classic evidence that the sell-off is about to end,” he said. “This is not happening now.”

For more analysis, see Kramer’s full explanation below.

“Beer aficionado. Gamer. Alcohol fanatic. Evil food trailblazer. Avid bacon maven.”