Automakers have spoiled the market for decades by increasing prices and upgrading. And now they are paying the price in a dismal magnitude.

Written by Wolf Richter for WOLF STREET.

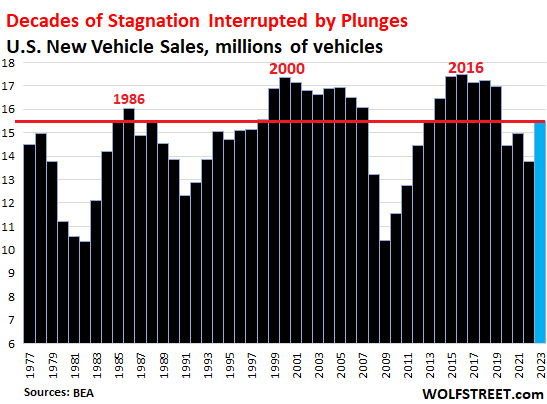

Total new vehicles delivered to retail and fleet customers (dominated by charter fleets) in the U.S. rose 12.4% from weak levels a year earlier to 15.46 million vehicles.

The best two years were 2000 and 2016, when 17.4 million and 17.5 million cars were sold. In 2023, sales were about 11% below the high in 2000 and 11.6% below the high in 2016. Compared to 1986, sales were down 3.7%, and compared to 1985, sales remained flat. That was almost it Four decades since! During the same period, the population of the United States increased by 40%!

Corrupting the market by increasing prices and upgrading.

It turns out that after decades of price increases and upgrading to maximize revenues and profits, automakers have created a market in the United States where the average American can no longer afford a new car, and are buying used cars — a financially sound strategy. .

Thus, automakers have spoiled the American market, as new car sales weaken in the best years and decline in the bad years.

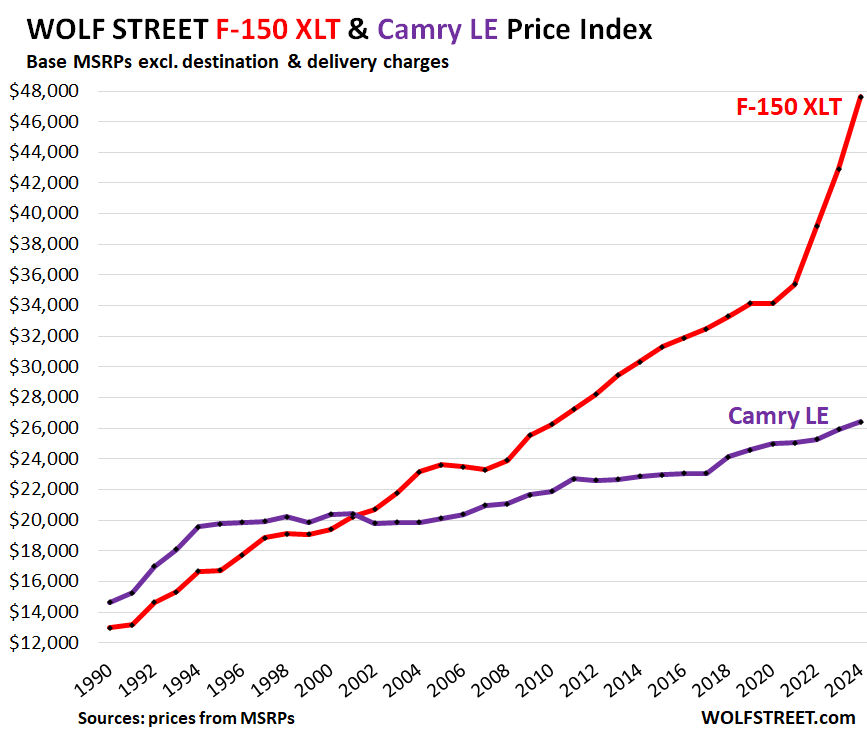

Full-size pickup trucks are a great example of rising prices and upgrading. There were only four automakers selling significant quantities of full-size pickup trucks in the United States: General Motors, Ford, Stellantis, and Toyota. Nissan will stop producing the Titan in 2024 due to declining sales. There are now two new players entering the market, in small numbers, namely Rivian and Tesla.

So, right now, four companies are selling full-size trucks by volume, with huge price increases year over year, and atrocious profit margins, which is a testament to monopolistic pricing behavior.

Here at WOLF STREET we developed our New Car Price Index based on the best-selling truck, the Ford F-150, and the best-selling car, the Toyota Camry. We've discussed this and our idea about oligopoly for pickup trucks here. And just for fun, here's the chart – since 1990, the suggested retail price of the F-150

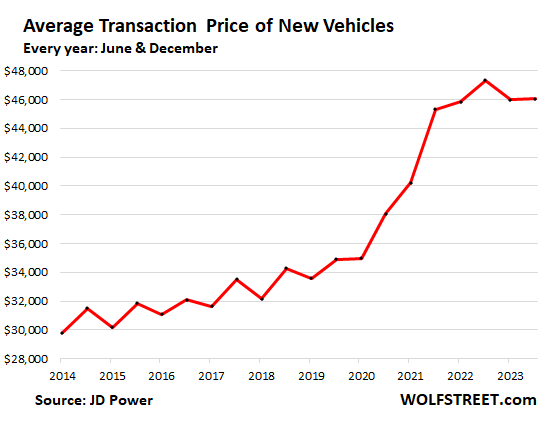

Average transaction price Including all incentives, rebates and stickers increased by 36% during the pandemic, from $34,900 in December 2019 to $47,300 in December 2022, according to J.D. Power data.

Then in 2023, inventory returned to retailers, discounts and incentives piled up, most of the obnoxious add-on stickers were gone (if you saw an attached sticker, “Just Say No”), and by December 2023, the average transaction price had dropped 2.7% to $46,055. Still ridiculous:

The largest automobile manufacturers in the United States.

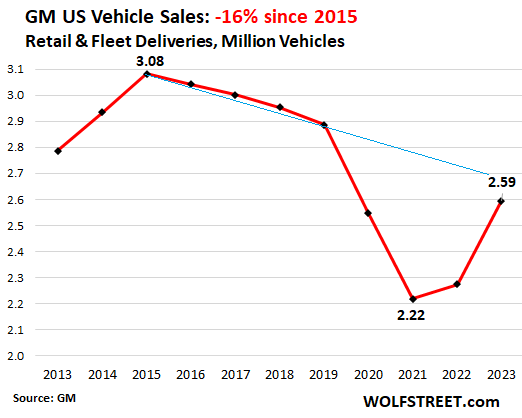

GM #1: Sales of all its brands in the United States in 2023 rose 14.1% to 2.59 million vehicles. But this is down 16% from its last peak in 2015.

Sales of GM's Bolt and Bolt EUV, its legacy electric vehicles, rose 62.8% in 2023, to 62,045 vehicles. After price cuts by GM, and after the federal tax credit, a base Bolt can be purchased for just over $20,000. There is a demand for decent cars in this price category. But 2023 was their swan song, as GM killed them at the end of the year.

GM is now launching several other electric vehicle models based on the new Ultium platform, but sales have only just begun and are minimal.

GM's sales declined in each of the four years leading up to the pandemic. Then a semiconductor shortage wiped out its inventory. But in 2023, stocks returned to normal. You can draw a mental line from 2015 to 2019 and then extend that line, and it will appear just above 2023, creating an ugly trend.

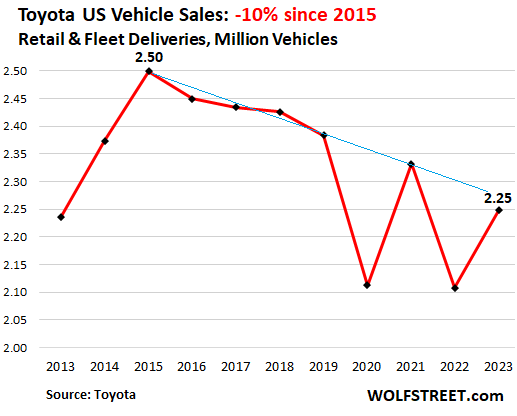

Toyota, No. 2Combined sales of the Toyota and Lexus brands in the United States increased by 6.6% in 2023, to 2.25 million vehicles. But this is down 10% from its last peak in 2015.

Toyota has no EV to speak of. A year ago, some lights came on, and Akio Toyoda, Toyota's long-time anti-EV CEO, was forced out and replaced by someone new, Lexus boss Koji Sato, under whom Toyota is now trying to build an EV strategy.

The trend in this chart — this streak from 2015 through 2019 and extending through 2023 — looks every bit as ugly as GM's trend:

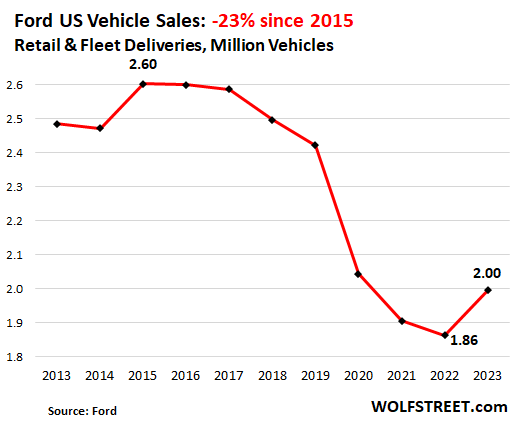

Ford, No. 3: Combined sales of its Ford and Lincoln brands rose 7.1% in 2023 to 1.996 million vehicles (well, 2.0 million), after seven straight years of declines. Since the last peak in 2015, sales have fallen by 23%.

Electric vehicle sales rose 17.9% to 72,608. This includes a 54.7% jump in F-150 Lightning sales to 24,165 trucks. The small startup, Rivian, has thus surpassed Ford's electric truck sales. That's how good Ford is at selling electric cars because it's now busy staring at an anti-electric car revolt by its own dealers.

Interestingly, in the fourth quarter, sales of ICE and hybrid vehicles fell 0.4% year-over-year, while EV sales rose 27.5%. The rise in electric vehicle sales pushed total sales up 0.8% in the fourth quarter year over year. Without electric cars, overall sales would have fallen by 0.3% year-on-year.

Ugly, ugly, ugly. I'm not even sure where to draw my mental trend line. But wait, Ford is spending billions of dollars on stock buybacks:

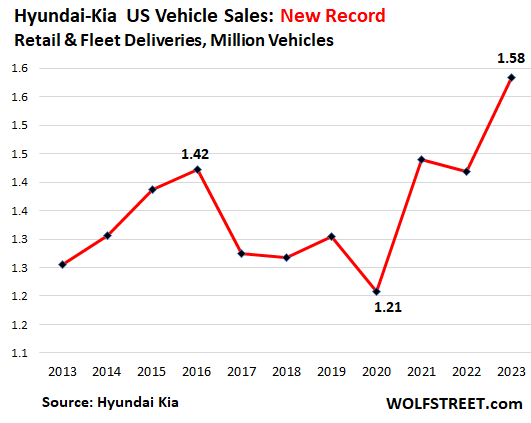

Hyundai-Kia, No. 4. Hyundai is the parent company of Kia, with Hyundai owning a 33.9% stake in Kia, Kia owning stakes in Hyundai subsidiaries, and they share vehicle platforms. So, for our purposes here, we look at the duo as one automaker with different brands.

They rock and roll. They surpassed FCA US (Stellantis) in sales in 2023 for the first time. On an annual basis, sales rose by 11.7% to a new record of 1.58 million vehicles (Hyundai 801,195 and Kia 782,451).

Electric Vehicle Sales: Hyundai sales of Ioniq EVs rose 76% to 46,917 vehicles. It also sells an electric version of the Kona Cross, but did not detail sales of the electric version (total Kona sales were 79,116). Kia electric vehicle sales fell 2% to 19,997 vehicles.

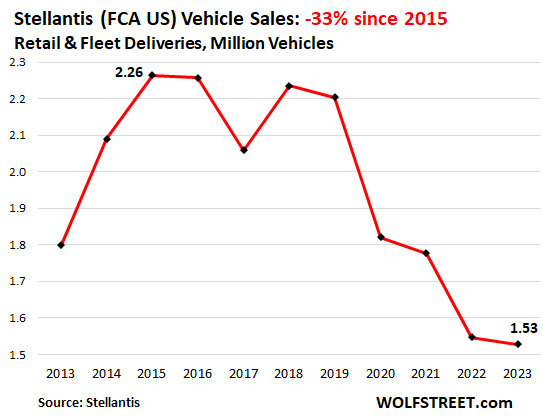

Stellantis #5: Dear, FCA's US sales fell another 1.3% in 2023, to 1.53 million vehicles. Since the last peak in 2015, sales have fallen by 33%. Hyundai-Kia has overtaken Fiat Chrysler Automobiles Group, USA for the first time, after being overtaken by Toyota years ago.

It's not mass production of any battery electric vehicles, but it does generate huge advertising for them. She said that the first electric car models are supposed to be launched by the end of 2024.

In terms of ugliness, the trend in this chart is in a class of its own, speaking of an existential crisis:

The Big Three U.S. automakers? General Motors, Ford, and Stellantis are the three largest automakers in the United States, or what's left of them. Toyota is ranked second in the United States, and it manufactures cars in the United States, but it is a Japanese company, and therefore a foreign car manufacturer. Hyundai-Kia ranks fourth in the United States, ahead of Stellantis, but they are a foreign duo, even though they make cars in the United States. Stellantis is a European company that bought FCA, US, but for whatever reason, we still consider FCA, US an American car manufacturer, even though FCA, US imports a lot of vehicles. So the lines became blurred.

We now have a fourth American automaker that is not yet large in terms of sales in the United States, but is growing rapidly: Tesla. All of its cars it sells in the United States are made in the United States – unlike other American automakers. Now, we need to talk about the “Big Four U.S. Automakers?” Or the Big Three, with Tesla entering and foreign automaker Stellantis exiting?

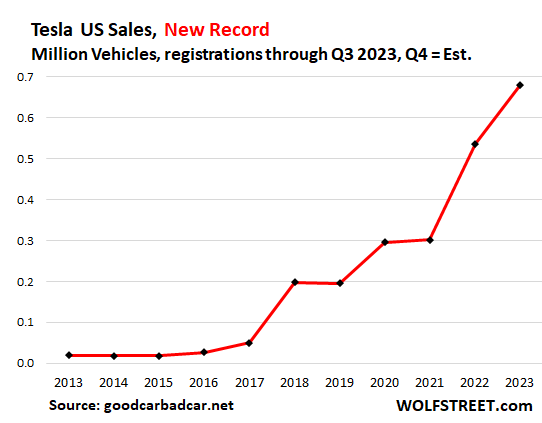

Tesla US sales are not disclosed. It only reveals global sales. But there is registration data. According to registrations, the Model Y became the No. 2 best-selling vehicle in the United States, behind the F-Series truck. But registration data lags. And we only have them until the third quarter of 2023.

Tesla's global deliveries in the fourth quarter were up 11% from the previous quarter, and up 20% year over year. Over the entire year, it rose 38%. We can estimate Q4 registrations in the US based on some modest growth from Q3, and that's what we did here, not super precisely, but close enough?

We added a modest amount of growth to the first three quarters of 2023 (registration data via com.goodcarbadcar.net) and came out to approximately 680,000, give or take. So this is much smaller than other US automakers. It's less than half of collapsing Stellantis sales.

But Tesla sales are headed in the right direction, after rising from almost nothing a few years ago. So I'm including them in this annual discussion here for the first time. Tesla has arrived.

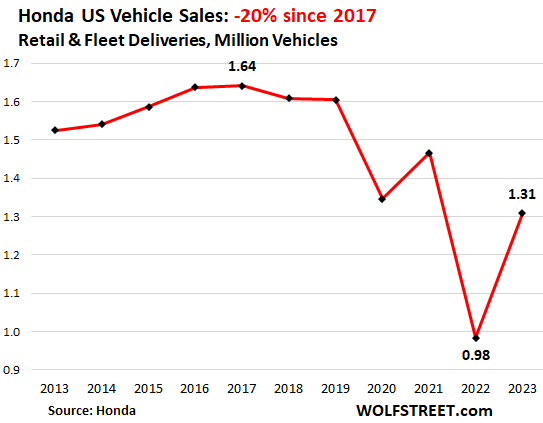

Honda Sales of the American Honda Motor Company jumped by 33% from their collapsed levels in 2022 when stocks ran out due to a shortage of semiconductors. Compared to the peak reached in 2017, sales are still down 20%.

Like Toyota, it has completely dropped the ball on EVs. In 2024, instead of developing its own electric vehicle from the ground up, it will introduce an electric vehicle (Prologue) based on GM's new Ultium platform, soon to be available at a dealer near you.

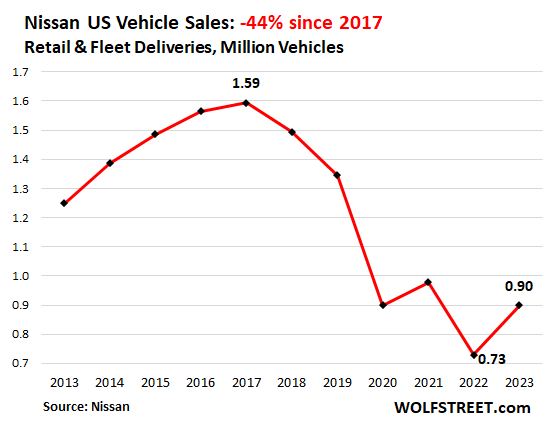

April: Combined sales of its Nissan and Infiniti brands rose 23% to 898,796 vehicles, but are still down 44% from their peak in 2017. An existential crisis in the making. Ugly, ugly, ugly:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate that very much. Click on the beer and iced tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Register here.

“Beer aficionado. Gamer. Alcohol fanatic. Evil food trailblazer. Avid bacon maven.”