In today’s fast-paced world, companies need to adapt if they are to stay relevant. Even the big tech giants I can’t feel at easeTo maintain their competitive edge, large companies such as Google and Amazon are constantly innovating and developing.

This series of graphics by Truman Doo It shows the income statements for five of the world’s largest companies — Amazon, Apple, Microsoft, Tesla and Alphabet — and shows how their financial statements have evolved since the date of their first public disclosures.

Editor’s Note: Click on any graphic to see a higher-resolution full-width version. Also, because these companies are in some cases 10,000 times as large as they were at the date of the IPO, the financial statements visible are not intended to be directly comparable in size.

Visual Income Data: From IPO to Today

Let’s start with Apple, the first company to go public and the biggest in the mix:

1. apple

view file full size infographic

In 1998, Apple called “Apple Computer”, because at that time, the company only sold computers and computers. However, over the next decade, the company expanded its product offerings and began selling several consumer tech products such as phones, portable music players, and even tablets.

Apple’s consumer technology has been very successful, by 2007 The company decided to delete “computer” from its name. Fast forward to today, and the company also generates revenue through services like Apple TV and Apple Pay.

While computers are still an essential part of their business, the iPhone has become the biggest revenue driver for the sake of the company.

In 2021, Apple generated $94.7 billion in profits, with a margin of 26%. Today, the company is one of the only major technology companies that has managed to withstand the decline in industry-wide valuations. The company is strong with a market capitalization of over $2 trillion Almost equal to the value Like Amazon, Alphabet, and Meta combined.

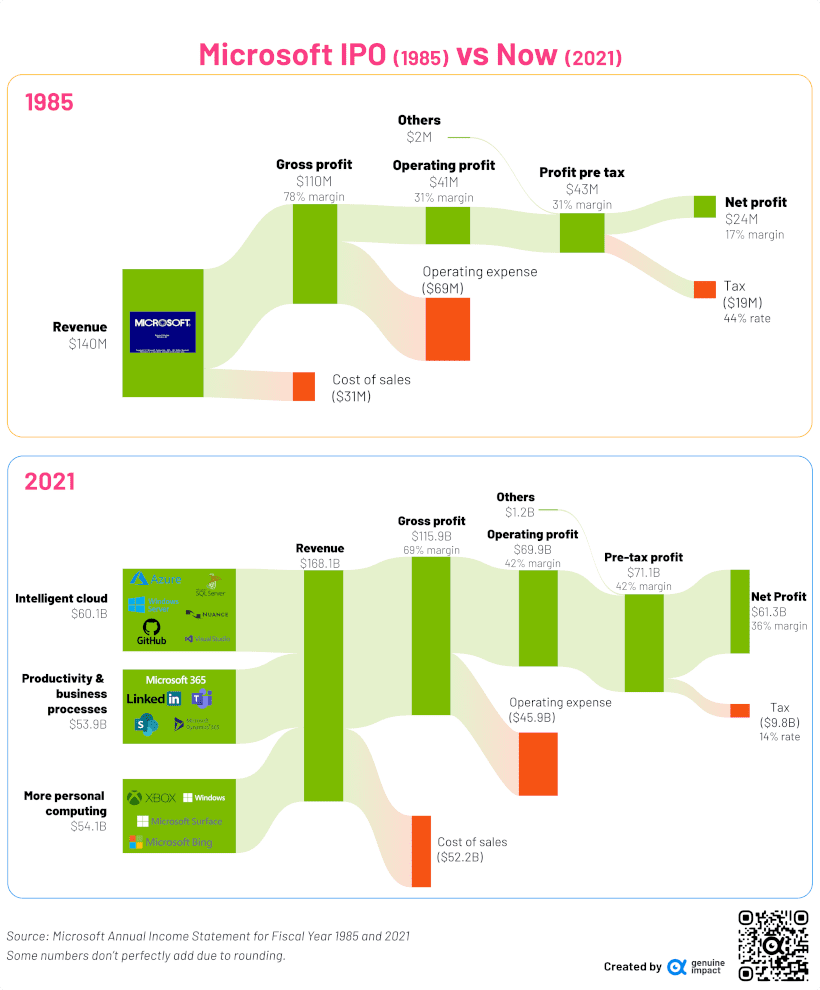

2. Microsoft

view file full size infographic

Microsoft, one of the oldest companies on this list, went public in 1985. At the time, the company was only selling microprocessors and software – hence the name Microsoft.

And while Microsoft’s main operating system (Windows) remains one of the major revenue drivers, the company’s product offerings have become more diversified.

Now, its revenue streams are split evenly between its cloud service (Azure), productivity tools (Office) and personal computing (Xbox and Windows OS).

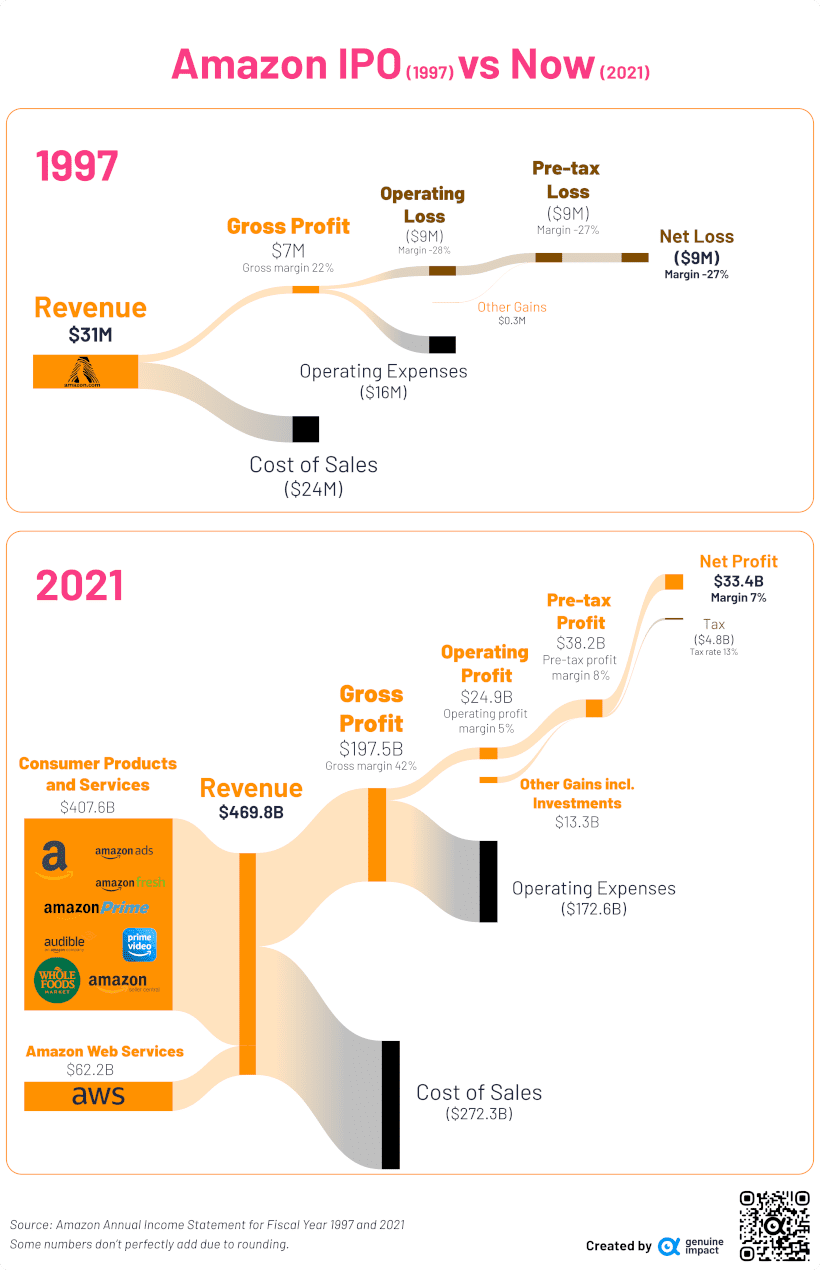

3. Amazon

view file full size infographic

When Amazon went public in 1997, the online retailer only sold books.

but by 1998Amazon is rapidly expanding its product offerings. Soon it was selling everything from CDs and games to electronics and even gadgets.

Fast-forward to now, and Amazon’s e-commerce segment is just a part of the company’s general business.

Amazon is also a cloud service provider (AWS), a supermarket chain (with its own grocery brands Amazon Fresh and its acquisition of Whole Foods) and even a video streaming service (Prime Video). In particular, AWS stands out as a important part of Amazon’s total business, generating 74% of operating profit.

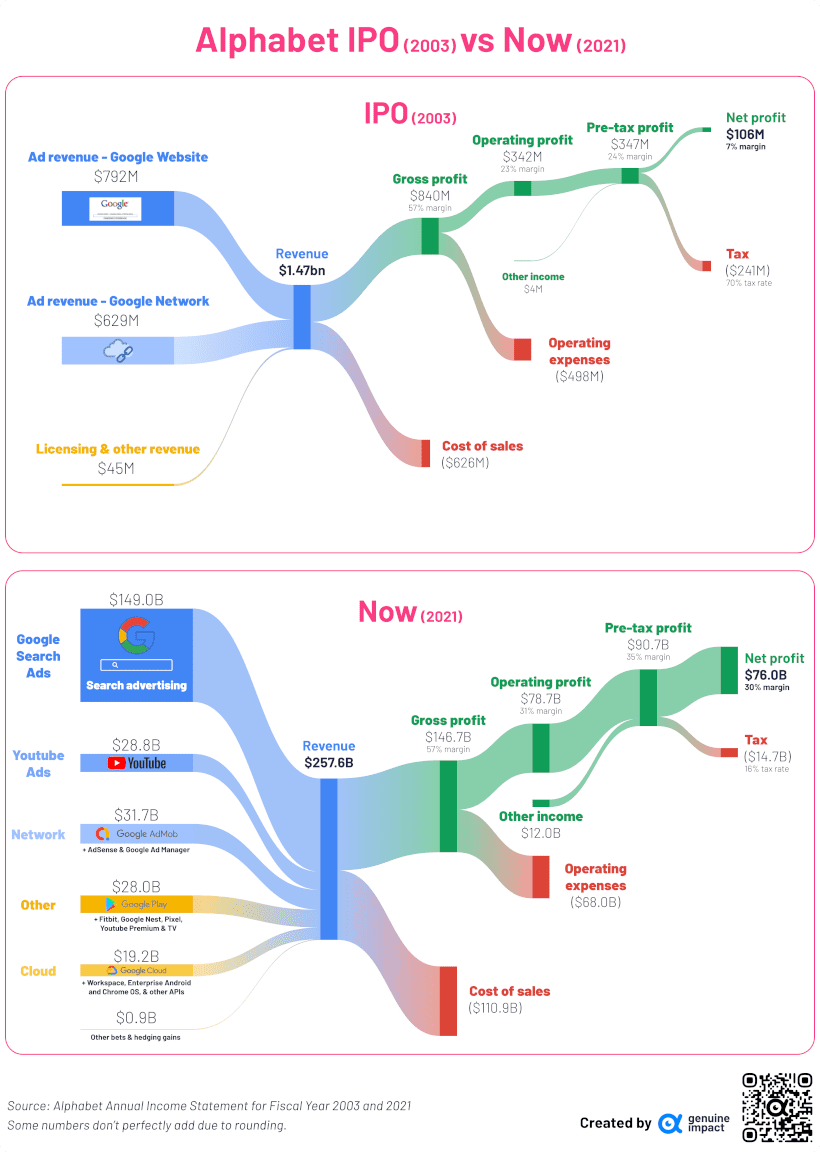

4. Alphabet

view file full size infographic

When Google went public in 2003, it was a simple search engine that was created 1.4 billion dollars in advertising revenue from its website and cloud.

Today, the company (now renamed Alphabet) is synonymous with the Internet, and accounts for a file The overwhelming majority of internet search traffic. Because of this, they generate hundreds of billions in advertising revenue each year.

The company also owns YouTube, and has branched out into different sectors such as consumer technology (Fitbit) and premium streaming (YouTube Premium & TV).

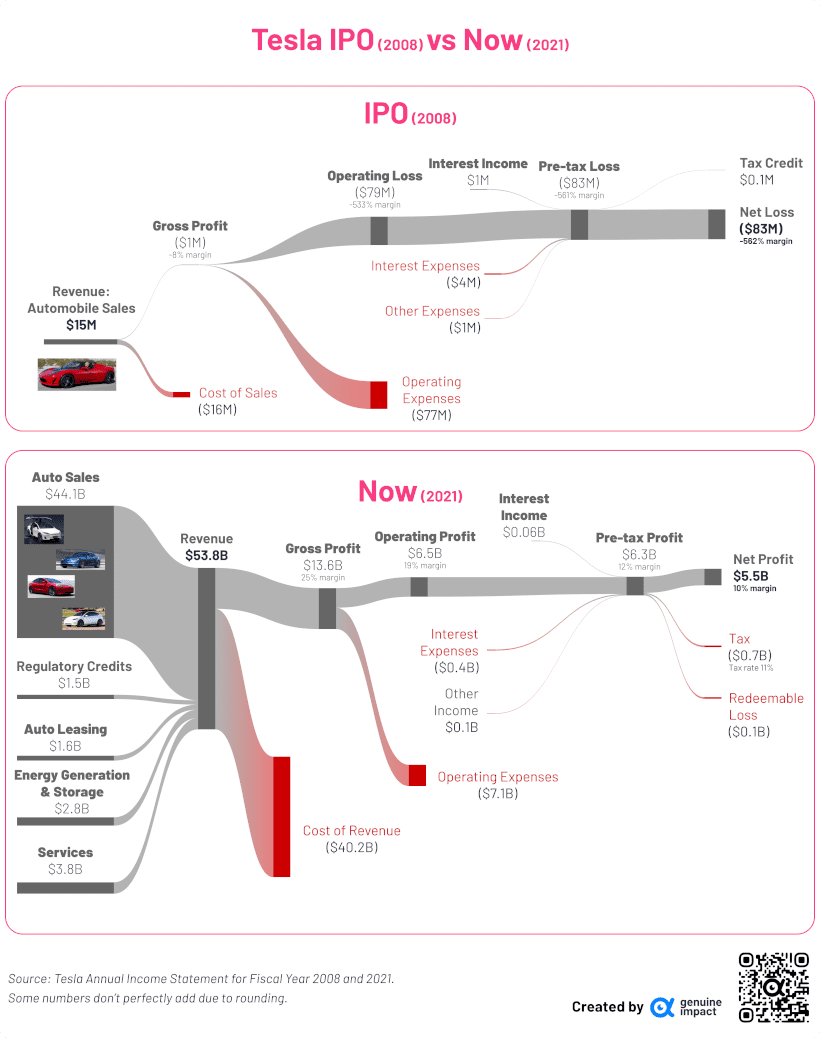

5. Tesla

view file full size infographic

Tesla’s IPO was in 2008, making it the smallest company on the list. And as the newest kid on the block, Tesla’s revenue streams haven’t changed as drastically as the others.

However, while electric vehicles remain the company’s main revenue driver, Tesla has managed to dip its toes into other vertical segments over the past 10 years. For example, in 2021, about $2.8 billion from her $53.8 billion in revenue from energy generation and storage.

This article was published as part of Visual Capitalist Creators Programwhich features data-driven visuals from some of our favorite content creators around the world.

“Freelance web ninja. Wannabe communicator. Amateur tv aficionado. Twitter practitioner. Extreme music evangelist. Internet fanatic.”