Part of the economic data awaits Wall Street this week as investors approach The final meeting of the Federal Reserve to set the interest rate this year.

New readings on Producer Price Index (PPI) – which measures inflation at the wholesale level – Durable Goods Orders and Consumer Confidence top the economic calendar in importance. Meanwhile, some other earnings reports will close the curtain on third-quarter reporting season.

US central bank officials are scheduled to meet on December 13-14 is expected to raise the benchmark interest rate by 50 basis points. Income of members of the Federal Reserve a Blackout period before assemblywhich limits speaking engagements before policy-making meetings.

Data releases closely watched for evidence from the Fed include the monthly jobs report, which The forecast for November blew on FridayAnd CPI data – after that Out December 13th They are two of the most comprehensive economic publications officials use to set policy. Until the new CPI data is released, the producer price measure will give traders another look at the direction of inflation.

Economists surveyed by Bloomberg expect the producer price index for November to rise 0.2%, an increase equal to the previous month, while easing to 7.1% from 8.0% year-on-year over the period. Core PPI, which excludes the volatile food and energy components, is expected to rise by the same monthly margin as the headline reading while declining from 5.8% to 6.7% y/y.

The inflation picture might have started to look different if the US had not It narrowly avoided a nationwide strike by railroad workersa stop that was expected to happen The economy was destroyed It hit wholesalers especially hard, after Congress hastily passed legislation to impose terms from a preliminary deal reached in September.

And as things stand, expectations for a 50 basis point rate hike next week are shared by the markets And the Big Wall Streetespecially after it was largely opinion Confirmed by Federal Reserve Chairman Jerome Powell Wednesday during a speech in Washington, DC

“Monetary policy is affecting the economy and inflation with uncertain delays, and the full effects of our rapid tightening so far are yet to be felt,” he said. “Therefore, it makes sense that we should reduce the pace of our price increases as we approach a level of restraint that will be sufficient to bring down inflation.”

Powell added that “the time to adjust the pace of interest rate increases may come as soon as the December meeting.”

And while expectations for a turnaround downward from the 0.75% highs achieved over the past four meetings are priced in highly, investors are now wondering how far the central bank’s tightening campaign will go, how far the Fed rate will go, and how long it will last. Stay there before any cuts.

Bank of America expects the final price to be A Range 5.00%-5.25%a view shared by many of its mega-bank peers, though Bank of America chief economist Michael Gapin speculated on a call with reporters last week that the rate could rise to 6% due to massive momentum in the labor market.

“The risks to our Fed policy outlook are skewed toward higher final interest rates given the persistent imbalance between labor supply and labor demand,” said Gaben-led Bank Bofa strategists in a note released Friday after the November hot jobs report. “A slower pace of increases seems appropriate from a risk management perspective, but strength in labor markets, in our view, likely means that the Fed will have to lean in the direction of doing more, not less, to put inflation on a sustainable downward path.”

With a slower pace and seemingly definitive halt to running rates, Wall Street’s attention has turned to the long-term effects of a higher rate environment on growth. In a weekly commentary, Ross Mayfield of Baird and Nicholas Bonsack, president and head of portfolio strategy at Strategas, a Baird company, predict that even if inflation continues to trend downward, the cost of getting levels from 4% to long-term price stability for the Fed . The 2% target becomes “incrementally higher”.

“It is likely to come with some significant shake-up between businesses and the job market,” they said in a note. “Ultimately, we think they’ll slow down the pace at which they raise rates and then take a long time to observe the landscape and the impact that might have.”

This view was shared by BlackRock CEO Larry Fink, who said at a conference last week that he was confident inflation would drop — just not to the 2% level and midway. period of economic recession.

At the Dealbook Summit in New York on Wednesday, Fink expressed his fears of waking up to a world of “2ish-3%” interest rates with “3-4%” inflation.

Elsewhere next week, the OPEC+ meeting this weekend will put energy markets in the spotlight. The oil cartel agreed Maintain current production levels To assess the global oil market as uncertainty over China and Russia looms over the commodity. The United States joined the European Union, the Group of Seven nations and Australia on Friday in capping the price of Russian oil at $60 a barrel.

On the earnings front, season finale Major Campbell’s Soup (CPB), GameStop (GME), from Broadcom (AVGO), chewy (CHWY), lululemon athletica (Lulu), oracle (ORCL).

While the third quarter saw vastly better results than feared, Wall Street strategists warned of zero earnings growth ahead.

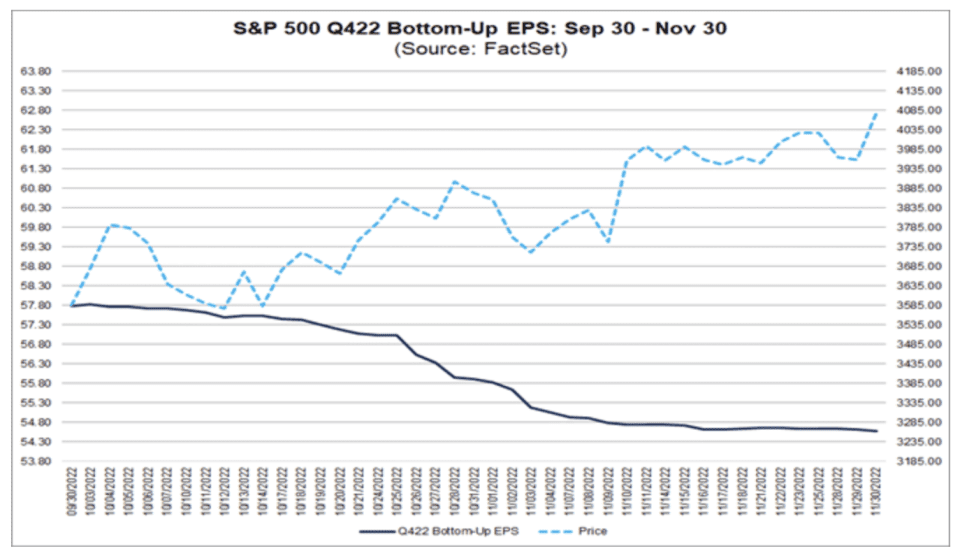

In October and November, analysts cut earnings estimates for the S&P 500 companies for the fourth quarter by a larger-than-average margin, according to Data from FactSet Research. The bottom-up EPS estimate for the fourth quarter decreased 5.6% to $54.58 from $57.79 in the Sept. 30 through Nov. 30 period.

“There is something to be said for the idea that inflation creates this monetary illusion that sales and profits remain high simply because prices are higher, especially relative to what might be considered a normal-sized decline in profits associated with a recession,” Mayfield and Bonsack also said in their weekly note. “When you combine that, it looks like the economy hasn’t been hurt as much.”

Accordingly, they added, “What we’re very focused on is corporate profit margins and the level of profitability, and there we’re starting to see some real sharp pain across the landscape. We expect earnings estimates to continue to decline as companies continue to weaken guidance and costs continue to increase.”

–

Economic calendar

Monday: S&P Global US Services PMIFinal November (46.1 expected, 46.1 over the previous month); S&P Global US Composite PMINovember Final (46.3 over the previous month); Factory ordersOctober (0.7% expected, 0.3% over the previous month); Durable goods ordersFinal October (1.0% over the previous month); Durable goods excluding transportationFinal October (0.5% expected, 0.5% over the previous month); Non-defense capital goods orders, excluding aircraftFinal October (0.7% over the previous month); Non-defense capital goods shipments, excluding aircraftFinal October (1.3% over the previous month); ISM Services IndexNovember (expected 53.5, 54.4 over the previous month)

Tuesday: trade balanceOctober ($77.0 billion, $73.3 billion forecast)

Wednesday: MBA Mortgage Applicationsfor the week ending December 2 (-0.8% over the previous week); non-agricultural productivitythe final third quarter (0.3% expected, 0.3% over the prior quarter); unit labor coststhe final third quarter (3.5% expected, 3.5% over the prior quarter); consumer balanceOctober (US$26.500 billion expected, US$24.976 over the previous month)

Thursday: Unemployment claims ratesfor the week ending December 3 (225,000 over the previous week); Continuing claimsfor the week ending November 26 (1.608 million over the previous week)

Friday: PPI final requeston a monthly basis, November (0.2% expected, 0.2% over the previous month); PPI excluding food and energyon a monthly basis, November (0.2% expected, 0.2% over the previous month); PPI excluding food, energy and tradeon a monthly basis, November (0.2% expected, 0.2% over the previous month); PPI final requeston an annual basis, November (7.1% expected, 8.0% over the previous month); PPI excluding food and energyon an annual basis, November (5.8% expected, 6.7% over the previous month); PPI excluding food, energy and tradeyear-over-year, November (5.4% over the previous month); Wholesale business saleson a monthly basis, October (0.4% over the previous month); wholesale stockmonth over month, final October (0.8% over the previous month); University of Michigan sentiments, First December (56.8 expected, 56.8 over the previous month)

–

Earnings calendar

Monday: gitlab (GTLB), sumologic (Sumo)

Tuesday: AeroVironment (AVAV), AutoZone (AZO), Casey General (Cassie) , Universe (CONN), Dave Webster (game), MongoDB (mdb), Signet Jewelry (SIG), stitch fix (SFIX) and Smith & Wesson Brands (swbi), Toll Brothers (TOL)

Wednesday: Brown Foreman (BF.B), Campbell’s soup (CPB), C3.ai (Amnesty International), GameStop (GME), Korn/Ferry (KFY), lovsac (the love), an initial outlet (OLLI), mathematical warehouse (SPWH), Thor Industries (althoug), United Natural Foods (UNFI), Verint systems (vrnt)

Thursday: from Broadcom (AVGO), chewy (CHWY), sina (CIEN), Costco Wholesale (cost), DocuSign (DOCU), domo (Domo), hi group (Momo), lululemon athletica (Lulu), national drinks (fizz), RH (R), Vail Resorts (MTN)

Friday: Lee Otto (L.I), revelation (ORCL)

–

Alexandra Semenova is a correspondent at Yahoo Finance. Follow her on Twitter @employee

Click here for the latest Yahoo Finance stock tickers

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for apple or android

Follow Yahoo Finance on Twitter TwitterAnd the FacebookAnd the InstagramAnd the FlipboardAnd the linkedinAnd the YouTube

“Beer aficionado. Gamer. Alcohol fanatic. Evil food trailblazer. Avid bacon maven.”