- ApeCoin recorded a positive performance in Q4, but the price of APE declined.

- Interest in Yuga Labs NFTs has declined as Bitcoin-based NFTs gain popularity.

The NFT sector has grown increasingly competitive over the past few months. As new entrants entered the market, interest in Yuga Labs' larger corporate kits slowly waned.

ApeCoin reported a positive Q4 performance

However, Epicoin [APE] The DAO's latest quarterly report showed that things are going relatively well. As of December 31, 2023, the Treasury owned 348 million monkeys.

Meanwhile, DAO spent $1.3 million to APE on operations and distributed $20.5 million in grants.

The report emphasized DAO's commitment to transparency by detailing grant allocations, including continued funding for 20 previously approved initiatives and community acceptance of five new grants.

Source: X

Not as good as Bitcoin

Although ApeCoin's Q4 report paints a positive picture, things could be affected by overall sentiment around Yuga Labs.

Since APE is a Yuga Labs token, it is highly associated with the NFTs in the Yuga Labs portfolio. The progress of NFT pools such as BAYC and MAYC has greatly contributed to the overall growth of the APE token.

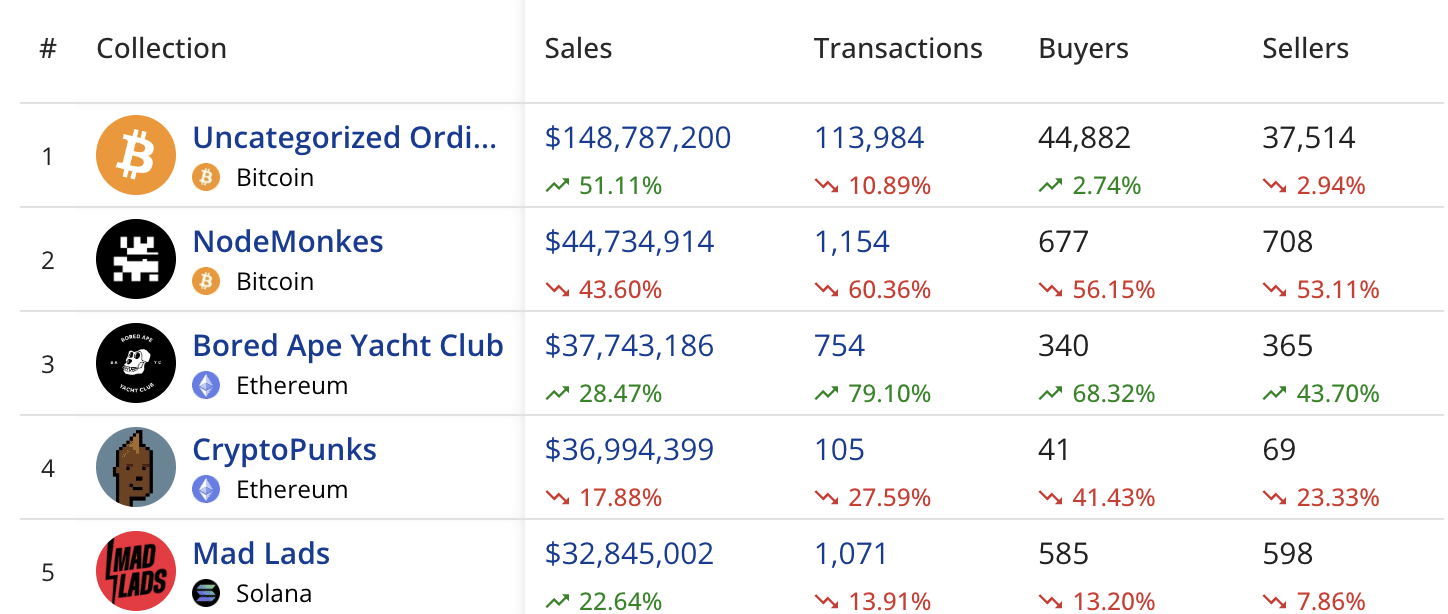

Although sales volumes for both BAYC and MAYC were high, they were not comparable to other NFT pools.

AMBCryptos analysis of CryptoSlam data revealed that BAYC lost the top spot to Bitcoin [BTC]Existing NFT collections.

Groups like Crypto Punks and Mad Lads have also been seen entering the top NFT group category, however, MAYC is nowhere to be found.

Source: Salam Encryption

How is the monkey?

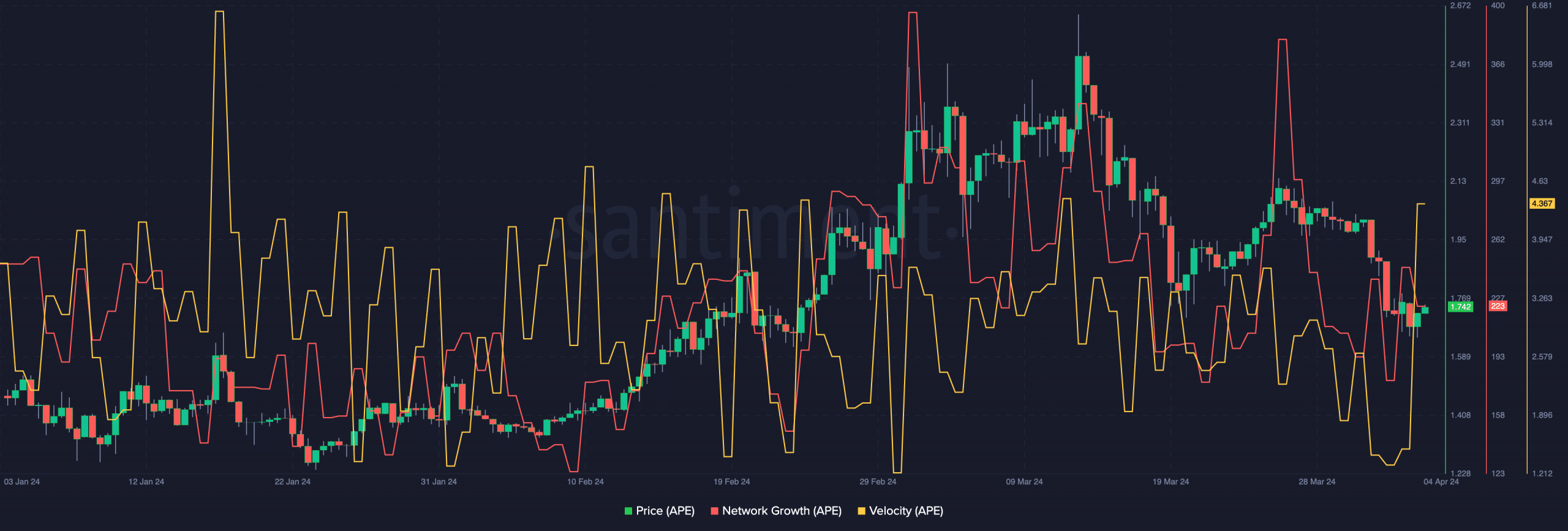

Speaking of the APE situation, we have seen that the price has dropped significantly over the past few days. At press time, APE was trading at $1,742 after testing the $2.49 level in the past few days.

APE network growth has also declined over the past few days. The decline in network growth indicates that new titles are slowly starting to lose interest in APE.

However, the speed of APE has increased, which means the frequency of APE trading has increased.

Source: Santiment

Read ApeCoin [APE] Price forecasts 2023-2024

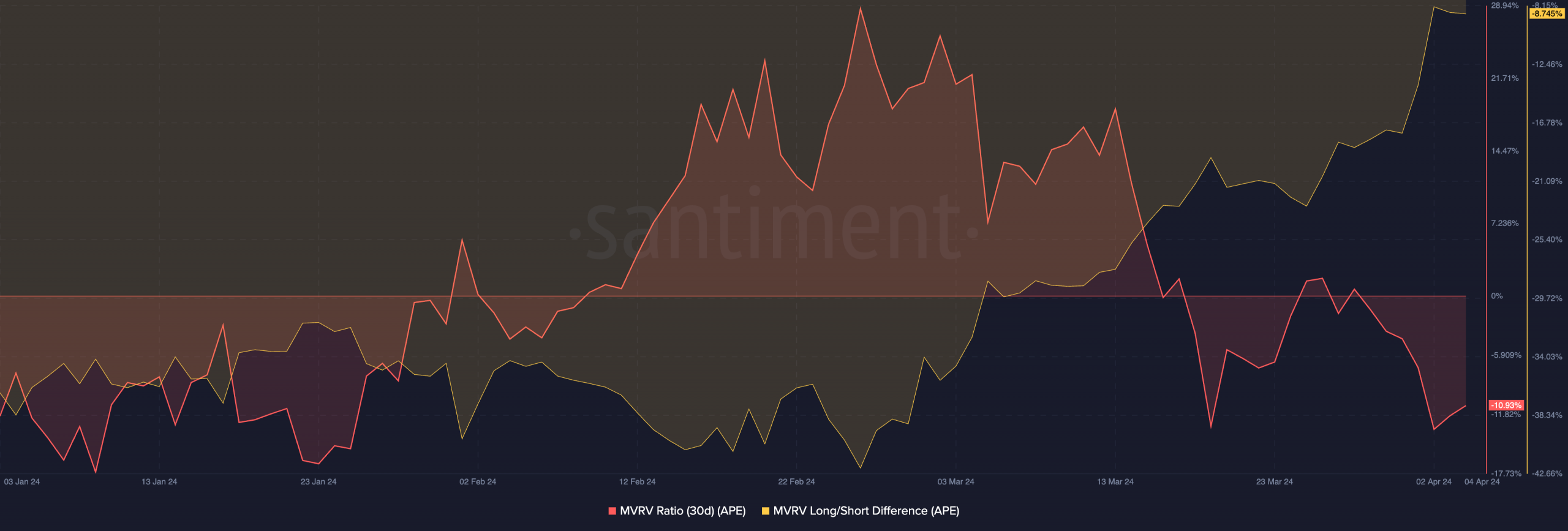

Regarding the MVRV ratio, there was a significant decline observed, indicating that most shareholders did not realize profits. In addition, the long/short spread has increased, indicating that long-term holders have outpaced short-term holders.

This means that due to the price correction, all short-term bond holders have sold their holdings. Long-term HODLers are less likely to sell their holdings and react to market fluctuations.

Source: Santiment

“Beer aficionado. Gamer. Alcohol fanatic. Evil food trailblazer. Avid bacon maven.”