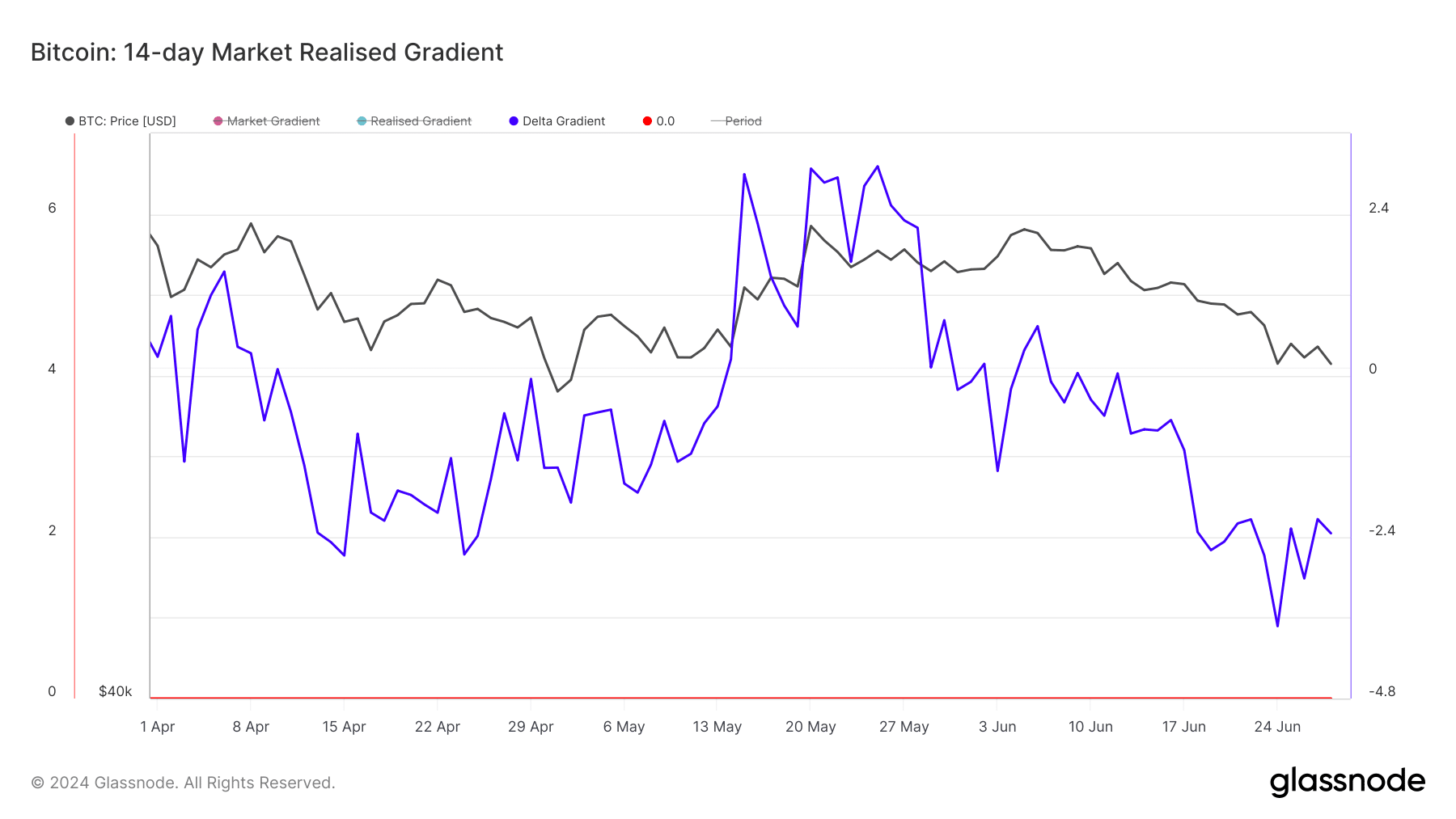

- The Delta Gradient indicator revealed that the potential decline in Bitcoin may last for one to two months.

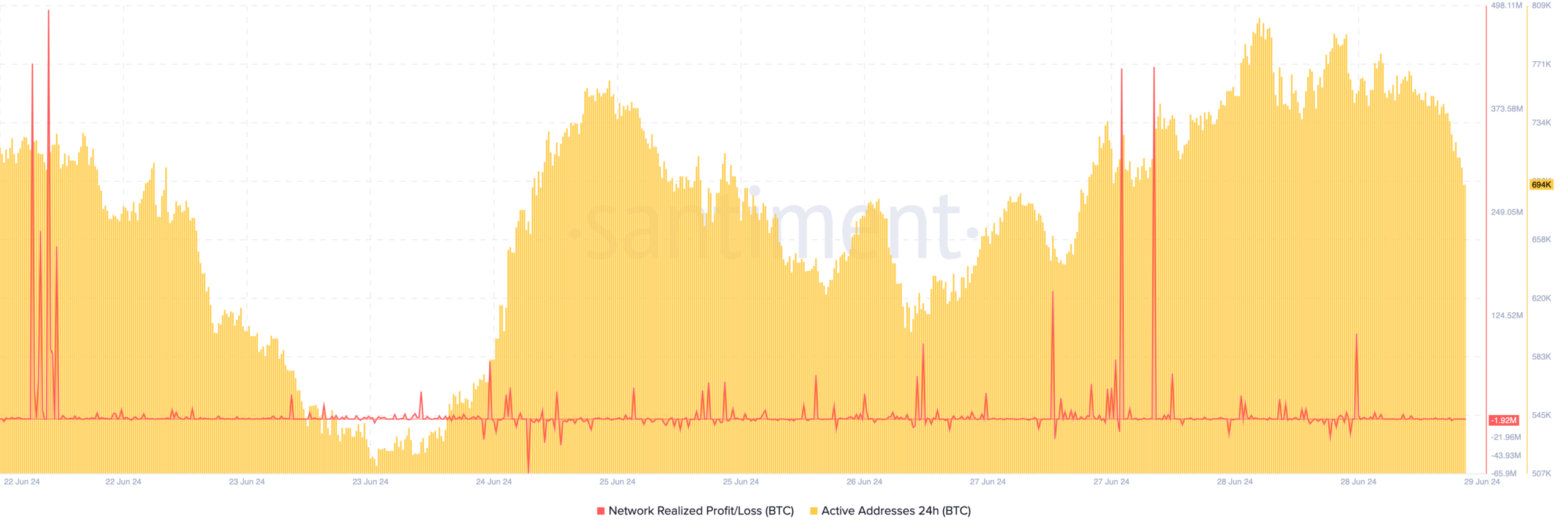

- The decline in active addresses raises concerns about demand for Bitcoin.

If Bitcoin [BTC] If the price action is consistent with historical patterns, it is definitely about to drop below the level it reached in the past few days. In short, this expected decline may continue for a month or two.

However, AMBCrypto did not come to this conclusion without the necessary data. In this article, we will analyze it. One of the most important metrics that matches this prediction is the Delta indicator.

South is the way

For those unfamiliar, Delta Gradient measures the relative change in momentum versus a cryptocurrency’s true organic capital.

When the gradient is positive, an uptrend is in place. Most often, this uptrend lasts for 28 to 60 days.

At the time of writing, Bitcoin’s downtrend is -2.34. this negative reading This indicates that the price may continue to undergo a downtrend. This expected downward trend may continue for a similar period.

Source: Glassnode

As of this writing, Bitcoin is trading at $61,062. This is a 4.96% decline in the past seven days. If the delta gradient continues to decline, Bitcoin could drop below $60,000 as it did a few days ago.

This was also in tune with Bitcoin’s reaction to the period in which the realized price rose above the spot value. Furthermore, we examined the generated profit/loss of the network.

Mixed signals appear on the charts

This metric shows the value of recent profitable or losing trades. A positive reading of the metric indicates that profit taking is high. As such, this could lead to lower prices.

However, if the scale is negative, it means that there is an increase in realized losses. If it is intense, the price may start to rise. According to Santiment, the realized profit/loss for the Bitcoin network was -1.92 million.

This means that a portion of the transactions take place on the chain It ended in losses.

This decline would normally be expected to herald rising prices, but this may not be the case due to dwindling activity on the Bitcoin network.

At the time of publication, the number of active 24-hour addresses had fallen to 694,000. A few days ago, the number was approaching a million. Active URLs are a measure of user activity.

Source: Santiment

Therefore, when it declines as it did recently, it means that market participants are not interacting with BTC at a high level. Therefore, this may lead to a noticeable decrease in demand for the currency

Realistic or not, this is the market cap of BTC in terms of ETH

If demand continues to decline, so will the price. But analyst Michael van de Poppe Express his opinion It is likely that the BTC correction may end soon.

According to him, the week that ended recently was good for the currency. He said,

“A very good weekly candle Bitcoin It’s getting closer here. I expect the correction to be relatively over. We didn’t get the more pronounced deep corrections of previous sessions either.

“Beer aficionado. Gamer. Alcohol fanatic. Evil food trailblazer. Avid bacon maven.”